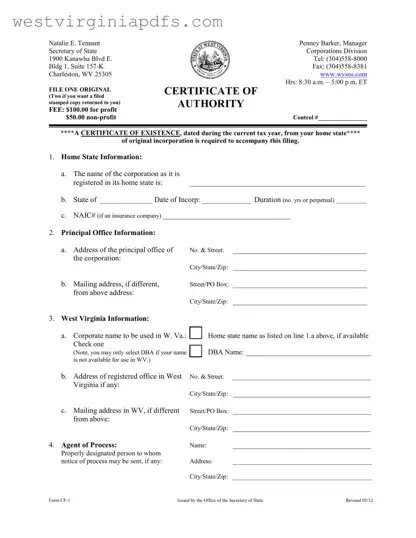

The West Virginia CF-1 form, issued by the Secretary of State, is a crucial document for corporations seeking to obtain a Certificate of Authority to operate within the state. This application outlines the necessary steps and required information for both...

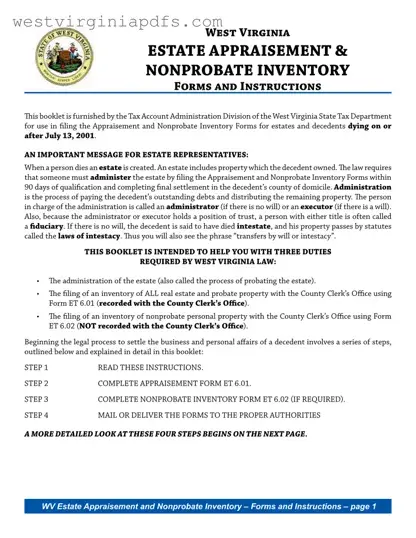

The West Virginia Estate Appraisement and Nonprobate Inventory Forms, provided by the Tax Account Administration Division of the West Virginia State Tax Department, are essential documents for estate administration in the state. These forms, along with the accompanying instructions, guide...

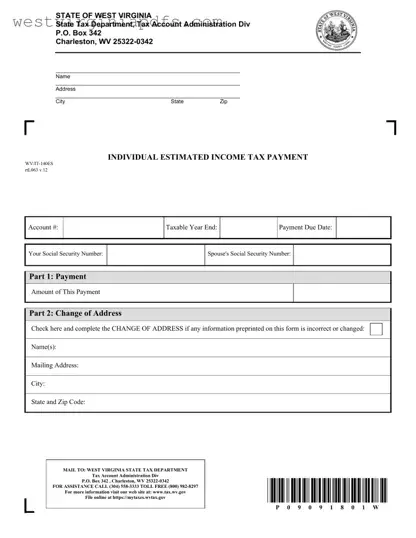

The West Virginia Estimated Tax form, officially designated as WV/IT-140ES, serves a vital role for residents who anticipate owing at least $600 in state taxes beyond withholdings. This necessity stems from the state's requirement that these taxpayers make advance payments...

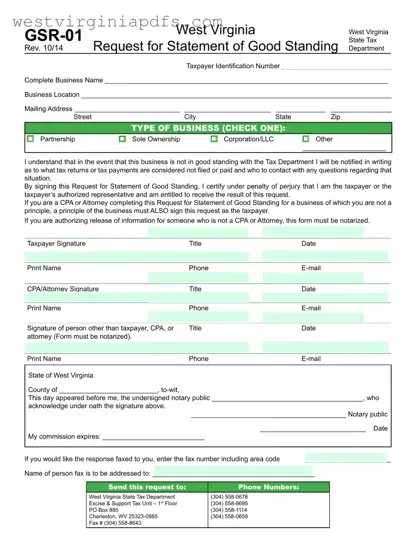

The West Virginia GSR-01 form, officially titled the Request for Statement of Good Standing, serves as a critical tool for businesses seeking to confirm their compliance with the West Virginia State Tax Department's requirements. This form, last revised in October...

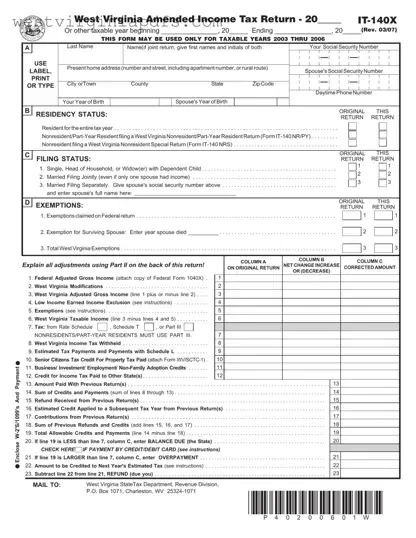

The West Virginia IT-140X form is an important document for residents who need to amend a previously filed state income tax return. Specifically designated for tax years 2003 through 2006, this form allows individuals to correct information or report changes...

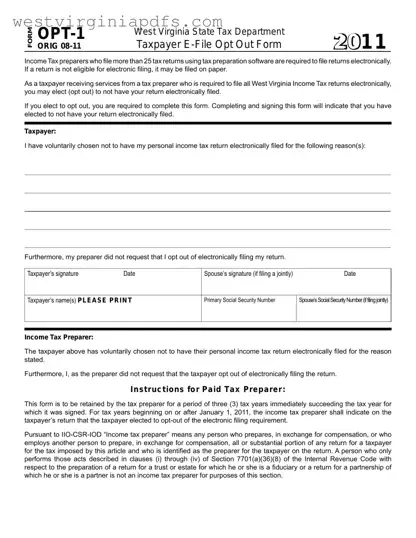

The West Virginia Opt 1 form is designed for taxpayers who prefer not to file their income tax returns electronically, despite their tax preparer being obligated to file all returns electronically if they prepare more than 25 tax returns using...

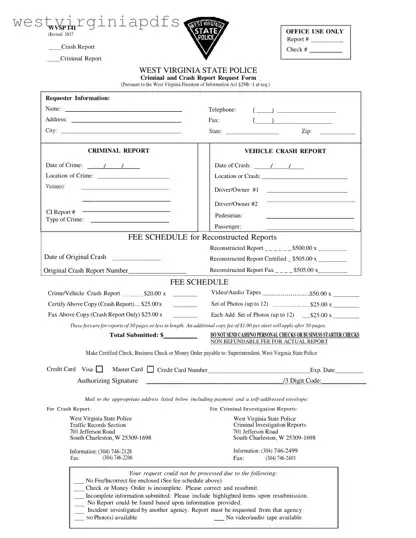

The West Virginia Police Report form, officially known as WVSP 141 (Revised 10/17), is a document utilized for requesting crash and criminal reports from the West Virginia State Police. It falls under the provisions of the West Virginia Freedom of...

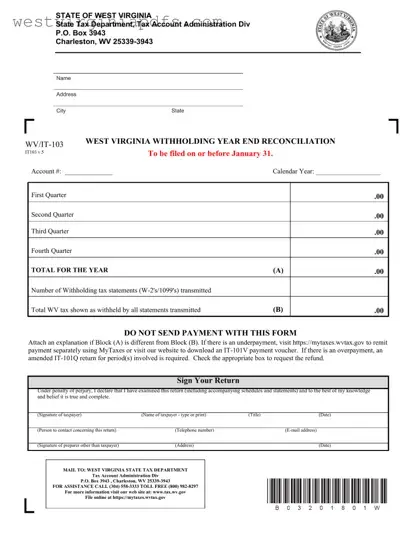

The WV/IT-103 form, known as the West Virginia Withholding Year-End Reconciliation, is a crucial document for employers within the state. Its primary role is to reconcile the total West Virginia tax withheld from employees' wages throughout the year, ensuring accurate...

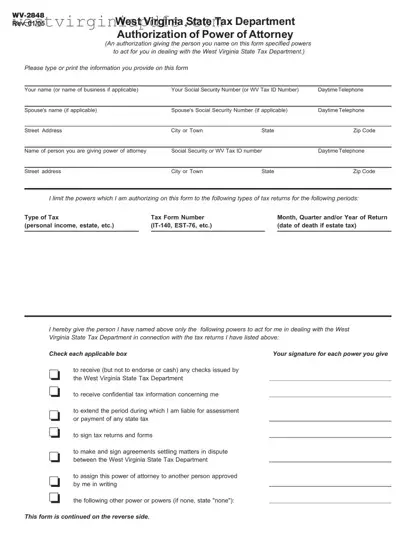

The WV-2848 form, formally recognized as the Authorization of Power of Attorney, facilitates the designation of an individual granted specific authorities to represent another in dealings with the West Virginia State Tax Department. This crucial document outlines the extent of...

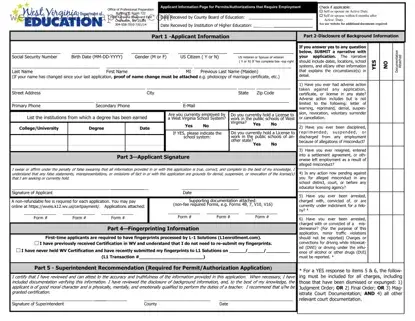

The WV 39 form is a vital document used in West Virginia for individuals seeking permits or authorizations in the field of professional preparation, particularly for those roles that necessitate an employment check. It encompasses a comprehensive range of information,...

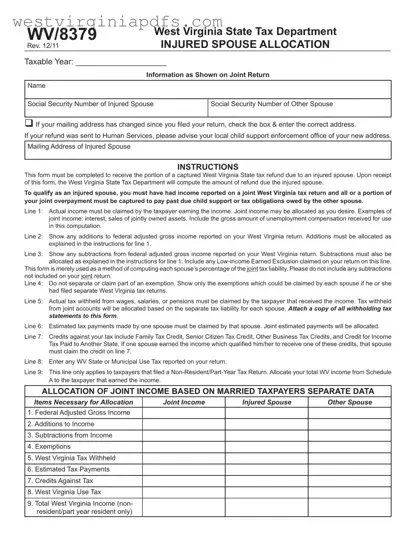

The WV 8379 form, designated for the State of West Virginia, represents a crucial tool for spouses seeking an equitable division of a state tax refund when one party has been disadvantaged financially due to the other's debt obligations. Specifically,...

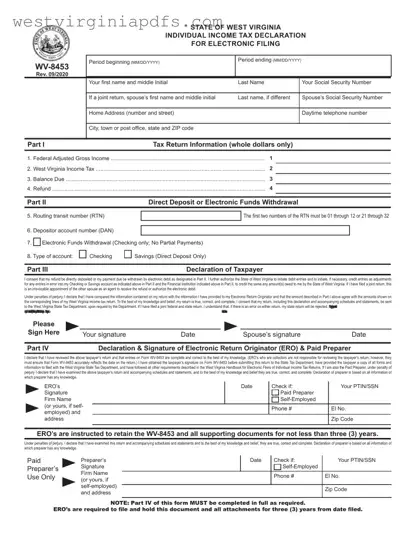

The WV 8453 form serves as the Individual Income Tax Declaration for Electronic Filing in the State of West Virginia, covering the tax period from January 1 to December 31, 2005. It is designed to facilitate the electronic filing process...