Fill Out a Valid Wv Spf 100 Form

In the world of business taxation, the WV SPF-100 form stands out as a critical document for S Corporations and Partnerships operating within West Virginia. Revised in August 2010, this form serves as the annual income and business franchise tax return, encapsulating both the financial intricacies of business structures and ensuring compliance with state tax obligations. At its core, the form requires detailed reporting on income, losses, and other pivotal financial figures that mirror federal return submissions, while also addressing state-specific tax scenarios, such as nonresident withholding and business franchise taxes. With fields that cover everything from the basic business information and tax year specifics to the minutiae of tax adjustments, payments, and credits, the WV SPF-100 requires attentive completion to accurately reflect a business's tax liability. Moreover, it incorporates schedules geared toward adjustments to federal income, tax calculations, and even allowances for governmental obligations, all of which play a role in determining a fair tax position. Importantly, the form also outlines the requirements for documentation submission, such as the necessity to attach the federal return and completed schedules that provide the backbone for the state return's computations. This comprehensive approach ensures that both the state and the businesses contribute to a transparent and equitable tax process, acknowledging the various activities and capital investments businesses undertake.

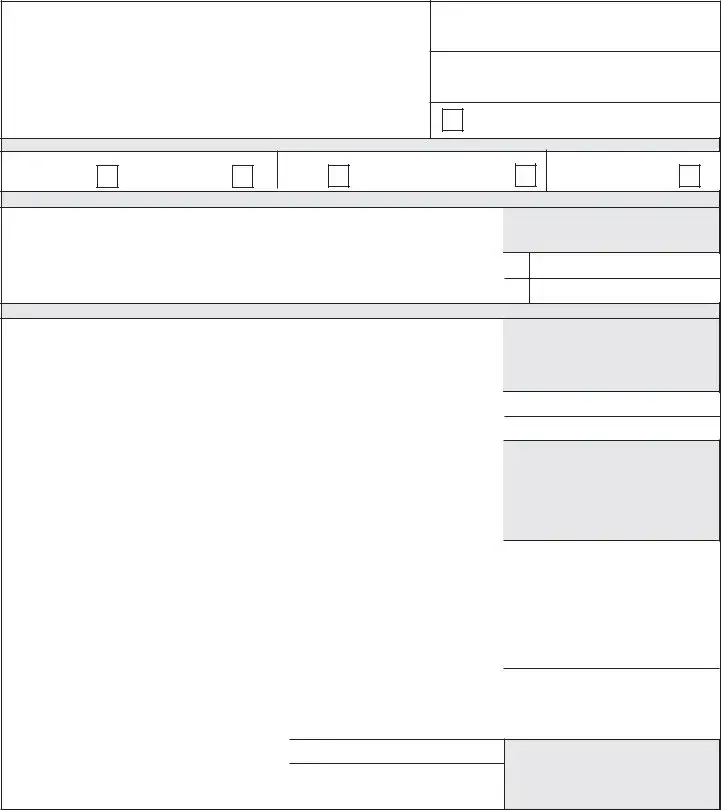

Sample - Wv Spf 100 Form

2010 |

|

WEST VIRGINIA INCOME/BUSINESS FRANCHISE TAX |

|

|

||||||||

|

|

|||||||||||

REV |

|

|

(PASSTHROUGH) |

|

|

|

FEIN |

|

||||

TAX YEAR |

|

|

|

ENDING |

|

|

EXTENDED |

|

|

|||

BEGINNING |

|

|

|

|

|

|

|

|

DUE DATE |

|

|

|

MM |

DD |

YYYY |

|

|

MM |

DD |

YYYY |

MM |

DD |

YYYY |

||

|

|

|

|

|||||||||

BUSINESS NAME AND ADDRESS

PRINCIPAL PLACE OF BUSINESS IN WV

TYPE OF ACTIVITY IN WV

52/53 WEEK FILER _______________________

day of week started

CHECK APPLICABLE BOXES

S CORPORATION

PARTNERSHIP

INITIAL

TYPE OF RETURN:

FINAL |

|

AMENDED |

|

|

|

FEDERAL RETURN ATTACHED

1120S |

|

1065 |

|

|

|

NONRESIDENT WITHHOLDING - COMPLETE SCHEDULE SP BEFORE COMPLETING THIS SECTION

1 |

. Percent of nonresidents filing composite personal income tax |

1 |

|

• |

|

|||

|

|

returns (from Schedule SP, Column C, Line 11) |

|

|

|

|

||

|

|

|

|

|

|

|

||

2 |

. Percent of nonresidents filing nonresident personal income tax |

2 |

|

• |

|

|||

|

|

returns (from Schedule SP, Column D, Line 11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3 |

. Income subject to withholding (from Schedule SP, Column G, Line 11) |

3 |

||||||

4 |

. West Virginia income tax withheld for nonresident shareholders/partners |

|

||||||

|

|

|||||||

|

|

(from Schedule SP, Column H, Line 11) |

|

|

|

|

|

4 |

BUSINESS FRANCHISE TAX/WITHHOLDING TAX |

|

|

|

|

|

|

||

5 |

. |

West Virginia taxable capital (Schedule B, Line 16) |

5 |

|

|

|

.00 |

|

6 |

. |

|

|

|

|

|

||

West Virginia business franchise tax (Line 5 x |

6 |

|

|

|

.00 |

|

||

|

|

0.0041 or $50.00, whichever is greater) |

|

|

|

|

||

|

|

|

|

|

|

|

||

7 |

. Tax credits (Schedule |

7 |

|

|

|

.00 |

|

|

.00

.00

..................................................................8 . Adjusted business franchise tax (Line 6 less Line 7) |

|

|

|

|

|

|

|

9 . Combined withholding/business franchise tax (add Line 4 and Line 8) |

|

|

|

||||

|

|

|

|

|

|

|

|

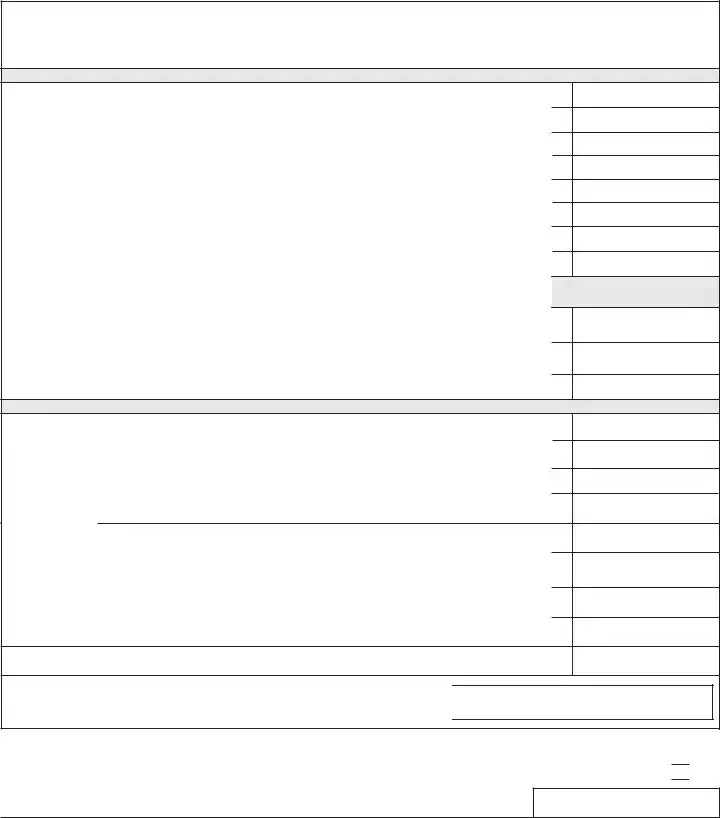

10 |

. Prior year carryforward credit |

1 0 |

|

.00 |

|

||

11 |

. Tax payments |

1 1 |

|

.00 |

|

||

12 |

. Withholding payments |

1 2 |

|

.00 |

|

||

13 |

. Amount paid with original return (Amended Return Only) |

1 3 |

|

.00 |

|

||

|

|

|

|

|

|

|

|

14 |

. Payments (add Lines 10 through 13) Must match total of Schedule of Tax Payments... |

|

|

|

|||

15 |

. Overpayment previously refunded or credited (Amended Return Only) |

|

|

|

|||

16 |

. Total Payments (Line 14 minus Line 15) |

|

|

|

|

|

|

17 |

. Tax Due- If Line 16 is smaller than Line 9, enter amount owed. |

|

|

|

|||

|

If Line 16 is larger than Line 9, enter |

|

|

|

|||

18 |

. Interest for late payment |

|

|

|

|

|

|

19 |

. Additions to tax for late filing and/or late payment |

|

|

|

|

|

|

20. Penalty for underpayment of business franchise estimated tax |

|

|

|

||||

|

|

|

|||||

|

Attach Form |

|

|

|

|||

.................................................................2 1 Total due with this return (add Lines 17 through 20) |

|

|

|

|

|

|

|

|

Make check payable to West Virginia State Tax Department |

|

|

|

|||

...........................2 2 Overpayment (Line 16 less Line 9) |

|

2 2 |

|

.00 |

|

||

|

|

|

|

|

|||

2 3 Amount of Line 22 to be credited to next year’s tax |

|

2 3 |

|

.00 |

|

||

|

|

|

|

|

|||

.............................2 4 Amount of Line 22 to be refunded |

|

2 4 |

|

.00 |

|

||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

8 |

.00 |

9 |

.00 |

1 4 |

.00 |

1 5 |

.00 |

1 6 |

.00 |

1 7 |

.00 |

1 8 |

.00 |

1 9 |

.00 |

2 0 |

.00 |

2 1 |

.00 |

REV |

RETURN FOR S CORPORATION AND PARTNERSHIP |

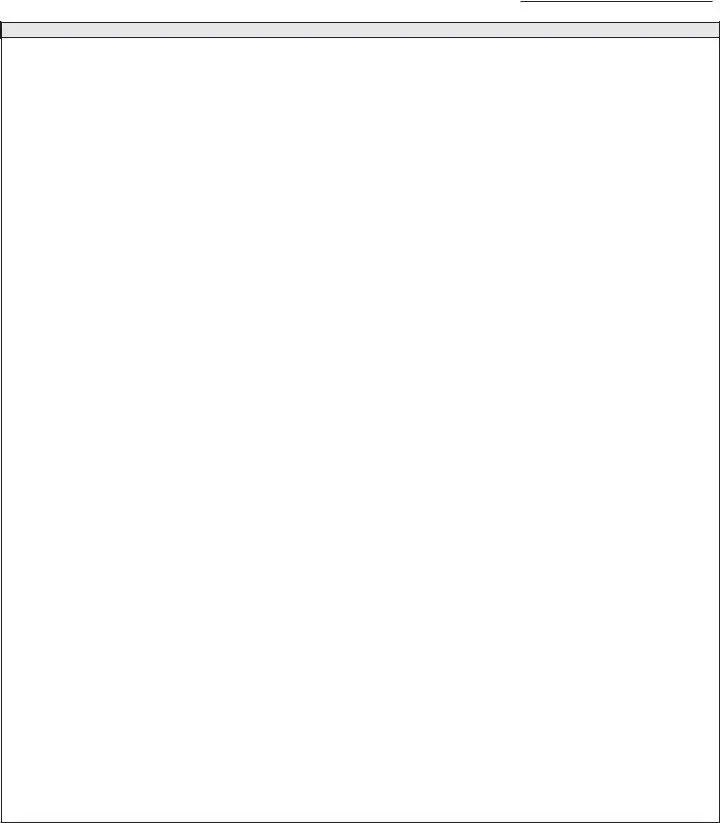

SCHEDULE A - INCOME/LOSS

1 |

............................... Income/Loss: S Corporation use Federal Form 1120S; Partnership use Federal Form 1065 |

1 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2 |

.Other income: S Corporation use Federal Form 1120S, Schedule K and |

2 |

|||||||||||||

|

Partnership use Federal Form 1065, Schedule K and |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||||

3 |

. Other expenses/deductions: S Corporation use Federal form 1120S, Schedule K; Partnership use Federal |

3 |

|||||||||||||

|

Form 1065, Schedule K |

|

|

|

|

|

|

|

|

|

|||||

4 |

. TOTAL FEDERAL INCOME: Add Lines 1 and 2 minus Line 3 - Attach federal return |

|

|

4 |

|||||||||||

5 |

. Net modifications to federal income (from Schedule |

5 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 |

. Modified federal income (sum of Lines 4 and 5). Wholly WV business go to Line 12; Multistate Corporation |

6 |

|||||||||||||

|

go to Line 7. Modified federal Partnership income (sum of Lines 4 and 5), go to Line 8 |

|

............................. |

||||||||||||

7 |

.Total nonbusiness income allocated everywhere: S CORPORATION ONLY use Form |

7 |

|||||||||||||

|

Schedule A1, Column 3, Line 8 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||||||

8 |

. Income subject to apportionment (Line 6 less Line 7) |

|

|

|

|

|

|

8 |

|||||||

9 |

. West Virginia apportionment factor: (Round to 6 decimal places) from |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||||

|

|

9 |

|

• |

|

|

|||||||||

|

or Part 3, Column 3; Partnership use Schedule B, Line 8 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|||||||||

10 |

. West Virginia apportioned income (Line 8 multiplied by Line 9) If Line 10 shows a loss, omit Page 1, |

|

|||||||||||||

|

Lines 1 through 4. However you must complete Schedule SP. S Corporations complete Lines 11 and 12 |

1 0 |

|||||||||||||

11 |

. Nonbusiness income allocated to West Virginia; S CORPORATION ONLY. Use Form |

|

|||||||||||||

|

Schedule A2, Line 12 |

|

|

|

|

|

|

|

|

1 1 |

|||||

12 |

. West Virginia income (wholly WV |

|

|||||||||||||

|

If Line 12 shows a loss, omit Page 1, Lines 1 through 4. However, you must complete Schedule SP |

1 2 |

|||||||||||||

SCHEDULE |

|

|

|

|

|

|

|

||||||||

INCREASING |

|

|

|

|

|

|

|

|

|

|

1 3 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13 |

. Interest income from obligations or securities of any state, or political subdivision other than this state |

||||||||||||||

|

|||||||||||||||

14 |

. US Government obligation interest or dividends exempt from federal but not exempt from state tax, less |

1 4 |

|||||||||||||

|

related expenses not deducted on federal return |

|

|

|

|

|

|

|

|||||||

15 |

. Interest expenses deducted on your federal return on indebtedness to purchase or carry |

securities |

1 5 |

||||||||||||

|

exempt from West Virginia income tax |

|

|

|

|

|

|

|

|||||||

16 |

. Total increasing modifications - Add Lines 13 through 15 |

|

|

|

|

|

|

1 6 |

|||||||

DECREASING |

|

|

|

|

|

|

|

|

|

|

|

||||

17 |

. Interest or dividends from US government obligations, included on your federal return |

|

|

1 7 |

|||||||||||

18 |

. US Government obligation interest or dividends subject to federal but exempt from state tax, less related |

1 8 |

|||||||||||||

|

expenses |

deducted on your federal return |

|

|

|

|

|

|

|||||||

19 |

. Refund or credit of income taxes or taxes based upon income, imposed by this state or any other jurisdiction, |

1 9 |

|||||||||||||

|

included |

on your federal |

return |

|

|

|

|

|

|

||||||

20 |

. Total decreasing modifications - Add Lines 17 through 19 |

|

|

|

|

|

|

2 0 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NET |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

21 |

. Net modifications to federal partnership income - Line 16 less Line 20. |

Enter here and on Schedule A, Line 5 |

2 1 |

||||||||||||

|

|

|

|

TYPE |

|

|

|

|

|

|

|

|

|

|

|

DIRECT |

|

|

CHECKING |

ROUTING |

|

|

ACCOUNT |

|

|

|

|

||||

DEPOSIT |

|

|

|

NUMBER |

|

|

|

|

|

|

|||||

|

|

|

|

|

NUMBER |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||||

OF REFUND |

|

|

SAVINGS |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true and complete. All appropriate sections of the return must be completed. An incomplete return will not be accepted as timely filed. Checking this box indicates waiver of my/our rights of confidentiality for the purpose of contacting the preparer regarding this return.

Signature of Officer/Partner or Member |

Name of Officer/Partner or |

Title |

Date |

Business Phone Number |

|

|

|

|

|

|

|

|

|

|

Paid preparer's signature |

Firm's name and address |

MAIL TO:

WEST VIRGINIA STATE TAX DEPARTMENT

TAX ACCOUNT ADMINISTRATION DIVISION

PO BOX 11751

CHARLESTON, WV

Date |

Preparer phone number |

*b54201002W*

REV |

RETURN FOR S CORPORATION AND PARTNERSHIP |

|

SCHEDULE

FEIN

S CORPORATION INCOME TAX - CALCULATION OF WEST VIRGINIA TAXABLE INCOME

1.Interest or dividends from any state or local bonds or securities..............................................

2.U.S. Government obligation interest or dividends not exempt from state tax, less related expenses not deducted on federal return................................................................................

3.Income taxes or taxes based upon net income, imposed by this state or any other jurisdiction, deducted on your federal return...............................................................................................

4.Federal depreciation/amortization for WV water/air pollution control facilities -

wholly WV corporations only....................................................................................................

5. Unrelated business taxable income of a corporation exempt from federal tax (IRC 512)..........

6. Federal net operating loss deduction..........................................................................................

7. Federal deduction for charitable contributions to Neighborhood Investment Programs if

claiming the WV Neighborhood Investment Programs Tax credit.............................................

8. Net operating loss from sources outside the United States........................................................

9. Foreign taxes deducted on your federal return.........................................................................

10. Deduction taken under IRC 199 (WV Code

11. Add back for expenses related to certain REIT’s and Regulated Investment

Companies (WV Code

12. TOTAL INCREASING ADJUSTMENTS - add Lines 1 through 11.......................................

13. Refund or credit of income taxes or taxes based upon net income, imposed by this state or any

other jurisdiction, included in federal taxable income..................................................................

14. Interest expense on obligations or securities of any state or its political subdivisions,

disallowed in determining federal taxable income.....................................................................

15. Salary expense not allowed on federal return due to claiming the federal jobs credit............

16. Foreign dividend

17. Subpart F income (IRC Section 951)..........................................................................................

18. Taxable income from sources outside the United States...........................................................

19. Cost of West Virginia water/air pollution control facilities - wholly WV only.............................

20. Employer contributions to medical savings accounts (WV Code

taxable income less amounts withdrawn for

21. SUBTOTAL of decreasing adjustments - add Lines 13 through 20..........................................

22. Allowance for governmental obligations/obligations secured by residential property

(from Schedule

1 |

.00 |

|

|

2 |

.00 |

|

|

3 |

.00 |

|

|

4 |

.00 |

|

|

5 |

.00 |

6 |

.00 |

7 |

.00 |

8 |

.00 |

|

|

9 |

.00 |

|

|

10 |

.00 |

|

|

11 |

.00 |

12 |

.00 |

13 |

.00 |

14 |

.00 |

15 |

.00 |

16 |

.00 |

17 |

.00 |

18 |

.00 |

19 |

.00 |

20 |

.00 |

21 |

.00 |

22 |

.00 |

*b54201003W*

2010 |

|

|

||||||||

REV |

RETURN FOR S CORPORATION AND PARTNERSHIP |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

23. TOTAL DECREASING ADJUSTMENTS - add Lines 21 and 22 |

|

22 |

.00 |

|||||||

24. Net modifications to Federal S Corporation Income - Line 12 less Line 23. Enter here and |

|

|

|

.00 |

||||||

|

on Schedule A, Line 5 |

|

|

|

|

23 |

||||

|

|

|

|

|

|

|||||

SCHEDULE |

BY |

RESIDENTIAL PROPERTY |

||||||||

|

|

|

|

|

|

|

|

|

||

1. |

Federal obligations and securities |

|

|

|

|

1 |

|

.00 |

||

2. |

Obligations of WV and any political subdivision of WV |

|

|

............... |

|

2 |

|

.00 |

||

3. |

Investments or loans primarily secured by mortgages or deeds of trust on residential property |

|

|

|

|

|

||||

|

|

|

.00 |

|||||||

|

located in WV |

|

|

|

|

3 |

|

|||

4. |

Loans primarily secured by a lien or security agreement on a mobile home or |

|

|

|

|

|

||||

|

located in WV |

|

|

|

|

4 |

|

.00 |

||

5. |

......................................................................................................TOTAL - add Lines 1 through 4 |

|

|

|

|

5 |

|

.00 |

||

|

|

|

|

|

|

|

|

|||

6. |

........................................................Total assets as shown on Schedule L, Federal Form 1120S |

|

|

|

|

6 |

|

.00 |

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

COMPLETED SCHEDULE B |

|

7. |

Line 5 divided by Line 6 (round to six (6) decimal places) |

7 |

|

• |

|

|

|

MUST BE ATTACHED |

||

|

|

|

|

|

|

|

|

|

|

|

8. |

Adjusted income - Add Schedule A, Line 4 and Schedule |

|

|

|

|

|

||||

|

21 plus total from Form |

|

8 |

|

.00 |

|||||

9. |

ALLOWANCE - Line 7 x Line 8, disregard sign - enter here and on Schedule |

|

9 |

|

.00 |

|||||

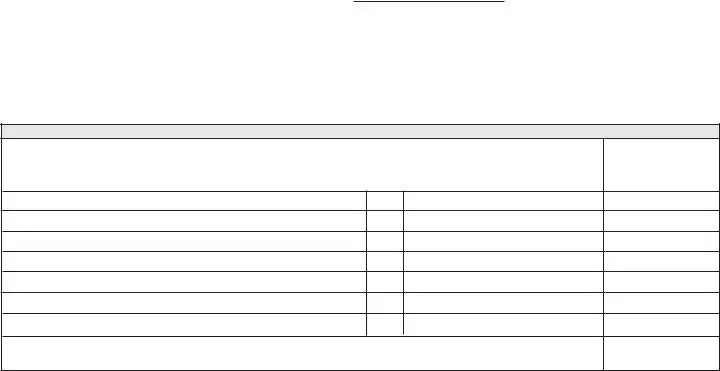

SCHEDULE OF TAX PAYMENTS

|

Identification Number |

MM |

DD YEAR |

Indicate EFTif |

Type: withholding, |

|

year credit |

||||

Name of business |

West Virginia Account |

|

Date of Payment |

|

estimated,extension, |

|

|

other pmts or prior |

|||

|

|

|

|

|

|

TOTAL - This amount must agree with the amount on Line 14, on front of return........................................................

Amount of payment

.00

.00

.00

.00

.00

.00

.00

.00

*b54201004W*

|

|

RETURN FOR S CORPORATION AND PARTNERSHIP |

FEIN |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE B - BUSINESS FRANCHISE TAX - CALCULATION OF WEST VIRGINIA TAXABLE CAPITAL |

|

||||||||||

|

|

|

|

|

Column 1 |

|

|

|

Column 2 |

|

Column 3 - Average |

|

|

|

|

|

|

Beginning Balance |

|

|

|

Ending Balance |

|

(Col 1 + Col 2) divided by 2 |

|

|

1. Dollar amount of common stock & preferred stock |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

2. |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

3. Retained earnings appropriated & unappropriated |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

4. Adjustments to shareholders equity |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

5. Shareholders undistributed taxable income |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

6. Accumulated adjustments account |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

7. Other adjustments account |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

...................8. Add Lines 1 through 7 of Column 3 |

|

|

|

|

|

|

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Less: Cost of Treasury Stock |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

10. Dollar amount of partner’s capital accounts |

|

.00 |

|

|

|

.00 |

.00 |

|

|||

|

11. Capital - Column 3, Line 8 less Column 3, Line 9 |

|

|

|

|

|

|

.00 |

|

|||

|

12. Multiplier for allowance for certain obligations/investments - |

|

• |

|

|

|

|

|||||

|

Schedule |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

.00 |

|

||||

|

13. Allowance - Line 10 or 11 multiplied by Line 12 |

|

|

|

|

|

|

|

||||

|

14. Adjusted capital - subtract Line 13 from Line 10, or 11. If taxable only in West Virginia check here |

|

.00 |

|

||||||||

|

and enter this amount on Line 16 |

|

|

|

|

|

|

|

||||

|

15. Apportionment factor - Form |

|

• |

|

|

COMPLETED FORM |

|

|||||

|

Part 3, Column 3 |

|

|

|

|

MUST BE ATTACHED |

|

|||||

|

16. TAXABLE CAPITAL - Line 14 multiplied by Line 15 - Enter on front of return, Line 5 |

.00 |

|

|||||||||

|

BUSINESS FRANCHISE TAX - SUBSIDIARY CREDIT |

|

|

|

|

|

|

|

||||

|

|

Column 1 |

|

Column 2 |

|

|

|

Column 3 |

Column 4 |

|||

|

|

Account number and name |

|

Recomputed Business |

|

Percentage |

Allowable Credit |

|||||

|

|

of Subsidiary or Partnership |

|

Franchise Tax Liability |

|

of Ownership |

(Column 2 x Column 3) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

.00 |

|

• |

|

.00 |

|

|||

|

FEIN |

|

|

|

|

.00 |

|

• |

|

.00 |

|

|

|

NAME |

|

|

|

|

|

||||||

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

.00 |

|

• |

|

.00 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

17. TOTAL - (Enter here and on Schedule |

.00 |

|

|||||||||

BUSINESS FRANCHISE TAX - TAX CREDIT FOR PUBLIC UTILITIES AND ELECTRIC POWER GENERATORS

18.Gross income in West Virginia subject to the STATE Business and Occupation Tax...............................................

19.Total gross income of taxpayer from all activity in West Virginia..............................................................................

20. Line 18 divided by Line 19 (Round to 6 decimal places) |

• |

21.Business Franchise liability - From front of return, Line 6, reduced by any Subsidiary Credit..................................

22.Allowable credit - Line 21 multiplied by line 20 - Enter here and on Schedule

.00

.00

.00

.00

**IMPORTANT NOTE REGARDING LINE 15**

FORM

FAILURE TO ATTACH COMPLETED FORM

WILL RESULT IN 100% APPORTIONMENT TO WEST VIRGINIA

*b54201005W*

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for reporting income/business franchise tax for S corporations and partnerships in West Virginia. |

| Revision Date | The form was last revised in August 2010, as indicated by the notation REV 08-10. |

| Governing Law | It is governed by West Virginia state tax laws, specifically pertaining to income and business franchise taxes. |

| Unique Features | Includes sections for nonresident withholding, business franchise tax, and a schedule for tax payments, highlighting detailed state-specific tax reporting requirements. |

Guide to Using Wv Spf 100

Filling out the WV/SPF-100 form is a critical process for S corporations and partnerships that need to file income and business franchise taxes in West Virginia. This form enables these entities to report their earnings, calculate their tax responsibilities, and apply any relevant credits. Careful attention to detail ensures that the information provided is accurate and compliant with state regulations. Following a step-by-step process not only simplifies filling out the form but also helps in avoiding common mistakes that could lead to penalties or delays.

- Enter the Federal Employer Identification Number (FEIN) at the top of the form.

- Fill in the tax year beginning and ending dates, along with the extended due date if applicable.

- Provide the business name and address, including the principal place of business in West Virginia.

- Indicate the type of activity in West Virginia and whether the entity is a 52/53 week filer.

- Check the applicable box to identify the entity as an S Corporation or Partnership.

- Specify if the return is initial, final, or amended, and if a federal return is attached.

- Complete the Nonresident Withholding section using percentages from Schedule SP as instructed.

- Enter the West Virginia taxable capital and calculate the business franchise tax.

- Outline any tax credits from Schedule WV/SPF-100TC, adjust the business franchise tax accordingly, and combine with the withholding tax.

- Include any prior year carryforward credit, tax payments, and withholding payments as indicated.

- If filing an amended return, specify amounts paid with the original return.

- Add lines 10 through 13 for total payments and subtract any overpayment previously refunded or credited.

- Determine the tax due, interest for late payment, and additions to tax for late filing and/or payment. Attach Form WV/SPF-100U if applicable.

- List the total due with this return, and calculate the overpayment if any.

- Decide how to handle any overpayment: credit to next year's tax or refund.

- Under penalties of perjury, sign and date the form, providing a business phone number. The preparer must also sign, indicating their firm's name and address.

- Mail the completed form to the West Virginia State Tax Department at the address provided at the end of the form.

Accuracy and thoroughness are key when completing the WV/SPF-100 form. Each section should be reviewed for completeness and compliance with state guidelines. This careful preparation supports a smoother process for both tax reporting and future fiscal planning for S corporations and partnerships operating within West Virginia.

Essential Points on Wv Spf 100

What is the purpose of the WV SPF-100 form?

The WV SPF-100 form is designed for S corporations and partnerships in West Virginia to file their income/business franchise tax returns. It serves to report income, calculate tax liabilities, and determine any applicable credits or withholdings for nonresident members.

Who needs to file the WV SPF-100 form?

S corporations and partnerships operating in West Virginia are required to file the WV SPF-100. This requirement applies regardless of whether the business is headquartered in West Virginia or another state, as long as it conducts business activities within the state.

What information is required on the WV SPF-100 form?

To complete the WV SPF-100, businesses need to provide details such as their Federal Employer Identification Number (FEIN), tax year, business name and address, the principal place of business in West Virginia, type of business activity, and whether they file on a 52/53 week basis. The form also requires detailed financial information, including income, losses, modifications to federal income, West Virginia taxable capital, tax withholdings for nonresidents, and any applicable credits.

What schedules are attached to the WV SPF-100 form?

Several schedules accompany the WV SPF-100, including Schedules A (Income/Loss), A-1 and A-2 (Modifications to Federal Income for Partnerships and S Corporations, respectively), A-3 (Allowance for Governmental Obligations/Obligations Secured by Residential Property), and a Schedule of Tax Payments. These schedules help in calculating the adjusted income, allowances, and apportioned tax liabilities based on business activities in West Virginia.

How is West Virginia taxable capital calculated for the Business Franchise Tax?

Schedule B of the WV SPF-100 aids in calculating the West Virginia taxable capital for the Business Franchise Tax. This calculation involves determining the average capital, applying any allowances for certain obligations or investments, and then adjusting the figure based on the business's apportionment factor specific to West Virginia.

Are there any specific tax credits available to businesses filing the WV SPF-100 form?

Yes, the form allows businesses to claim various tax credits, such as credits for investments in the state, credits related to employment, and specific credits for public utilities and electric power generators. These credits are detailed within the form and its schedules, particularly on Schedule WV/SPF-100TC for tax credits.

What happens if a business files an amended WV SPF-100 form?

If amendments are necessary, businesses can file an amended WV SPF-100 form to correct any inaccuracies or claim additional deductions or credits not previously utilized. The form specifically asks whether it is an amended return and includes sections to report payments made with the original return and any changes to the tax liability or credits.

How can a business determine its tax due or overpayment?

The WV SPF-100 form includes a detailed calculation section for determining the tax due or any overpayment. Businesses subtract total payments and credits from the combined withholding and business franchise tax to determine if additional payments are due or if they are entitled to a refund or credit toward the next year's tax liability.

Where should the WV SPF-100 form be mailed?

Completed WV SPF-100 forms should be mailed to the West Virginia State Tax Department, Tax Account Administration Division, at the address provided on the form. It is important to ensure that all required schedules and attachments are included with the mailed form to avoid processing delays.

Common mistakes

When it comes to completing the WV SPF-100 form, a range of common mistakes can easily occur if individuals aren't careful. This form, essential for S Corporations and Partnerships in West Virginia, outlines income, business franchise tax, and other financial details necessary for tax compliance. Here are four of the most prevalent missteps to avoid:

- Failure to attach required federal returns: Many forget the crucial step of attaching their Federal Forms 1120S or 1065. This omission can delay processing as these documents are vital for verifying income and the correct application of tax laws.

- Incorrect calculation of withholding taxes for nonresidents: Often, the percentage of nonresidents filing composite personal and nonresident personal income tax returns is mistakenly reported. This misstep affects the income subject to withholding and the actual West Virginia income tax withheld for nonresident shareholders or partners.

- Misreporting West Virginia business franchise tax: Calculating the West Virginia taxable capital and the resulting franchise tax requires precision. Yet, some incorrectly report these figures, leading to discrepancies in tax liabilities.

- Inaccurate reporting on Schedule A modifications: Both increasing and decreasing modifications to federal income often see errors. Accurately reporting items such as interest from government obligations, US Government obligation interest, or deductions taken under IRC 199 is essential for correct tax computation.

Avoiding these mistakes requires careful attention to detail and thorough understanding of the form's requirements. By double-checking attachments, accurately calculating taxes, and ensuring precise reporting of modifications to federal income, filers can ensure a smoother submission process. Moreover, when in doubt, consulting with a tax professional can provide valuable guidance and peace of mind.

Documents used along the form

Filing the WV/SPF-100 form for S Corporations and Partnerships in West Virginia is a vital step for adhering to state tax obligations. However, to ensure comprehensive compliance and accuracy in reporting, additional forms and documents might be necessary depending on specific circumstances. Here's a list of forms and documents often used along with the WV/SPF-100 form:

- Form 1120S: U.S. Income Tax Return for an S Corporation. This form is used by S corporations to report their income, gains, losses, deductions, credits, etc., to the IRS.

- Form 1065: U.S. Return of Partnership Income. For partnerships, this form is necessary for reporting their financial information to the IRS.

- Schedule K-1 (Form 1120S): Shareholder's Share of Income, Deductions, Credits, etc. It provides each shareholder with their portion of the S corporation's income, losses, and dividends.

- Schedule K-1 (Form 1065): Partner's Share of Income, Deductions, Credits, etc. This document provides each partner with their share of the partnership's income, credits, and deductions.

- Form WV/SPF-100APT: Apportionment of Income. Used by multistate S corporations and partnerships to calculate the portion of income attributable to West Virginia.

- Form WV/SPF-100TC: Tax Credit Schedule. This form accompanies the WV/SPF-100 when claiming specific tax credits.

- Form WV/SPF-100U: Underpayment of Estimated Business Franchise Tax. For entities required to make estimated tax payments, this form helps calculate any underpayment penalties.

- Schedule SP: Nonresident Withholding Schedule. Used if the entity has nonresident shareholders or partners, to calculate and report the tax withheld on their behalf.

- Direct Deposit Form: For businesses opting to receive their refunds directly into a bank account, this form provides the necessary banking details.

- Schedule of Tax Payments: Documents the various payments made throughout the year, such as estimated payments or withholding, to be reconciled with the total tax liability.

Each document plays a part in ensuring that all relevant income, deductions, and credits are accurately reported. Understanding and utilizing these forms properly can help avoid errors and ensure that businesses meet their tax responsibilities efficiently and effectively.

Similar forms

The WV/SPF-100 form shares similarities with the IRS Form 1120S, primarily used by S corporations for federal income tax filing. Like the WV/SPF-100, Form 1120S requires information on income, losses, and deductions to determine the corporation’s federal tax liability. However, Form 1120S focuses on federal tax obligations, while WV/SPF-100 combines income and business franchise tax responsibilities for West Virginia, highlighting its unique approach to state-level tax requirements for pass-through entities.

IRS Form 1065 mirrors the WV/SPF-100 in that it serves partnerships for federal tax purposes, detailing income, gains, losses, deductions, and credits to calculate the partnership’s federal tax. Both forms are designed for pass-through entities, ensuring that the income flows through to the partners or shareholders, who then report it on their personal tax returns. The essential difference lies in the jurisdiction focus, with Form 1065 addressing federal requirements and WV/SPF-100 targeting West Virginia state tax obligations.

The Schedule K-1, a component of the IRS Form 1065, is also closely related to the WV/SPF-100. Schedule K-1 provides a detailed account of each partner's share of the partnership’s income, deductions, and credits. This detailed breakdown facilitates the pass-through taxation process, similar to how portions of the WV/SPF-100 require the distribution of income and deductions to be reported for S corporations and partnerships within West Virginia.

Form WV/SPF-100APT resembles the WV/SPF-100 as an auxiliary form required for more specific adjustments. While the WV/SPF-100APT focuses on apportionment and adjustments related to S corporation income within West Virginia, it complements the broader tax reporting and calculation purposes of WV/SPF-100 by providing necessary details for accurately determining state taxable income for entities operating in multiple states.

The WV/SPF-100TC Tax Credit form is another document associated with the WV/SPF-100, specifically tailored to calculate and claim available tax credits that can offset the overall tax liability. Similar to deductions and credits sections in the WV/SPF-100, this focused form aids businesses in lowering their tax dues through various state-provided incentives, emphasizing the importance of understanding and utilizing state-specific tax benefits to reduce the tax burden.

Form WV/SPF-100U is pertinent for underpayment penalties for business franchise tax, closely associated with WV/SPF-100’s aim of ensuring businesses meet their tax obligations accurately and on time. By addressing potential penalties for underpayment, the form complements WV/SPF-100’s broader goal of maintaining tax compliance among S corporations and partnerships within the state, highlighting the consequences of miscalculating estimated tax payments.

The Federal Form 1120S Schedule K and K-1, similar to parts of the WV/SPF-100, detail supplemental income and deductions for S corporations at the federal level. These schedules, when prepared alongside IRS Form 1120S, serve a similar function to portions of WV/SPF-100. They ensure that S corporations properly report income and deductions, which are then passed through to shareholders, emphasizing the symbiotic relationship between federal and state tax reporting obligations for pass-through entities.

Dos and Don'ts

When completing the WV SPF-100 form, a thorough approach is necessary to ensure accuracy and compliance with state requirements. The following guidelines outline what individuals should and shouldn't do when filling out this form for an S Corporation or Partnership in West Virginia:

- Do: Double-check the Federal Employer Identification Number (FEIN) to ensure it matches your official documents. Incorrect identification numbers can lead to processing delays.

- Do: Accurately report the tax year and any extensions. This information is crucial for the state to align your financial data with the correct fiscal period.

- Do: Include all relevant schedules and attachments, such as Federal Returns (1120S for S Corporations or 1065 for Partnerships), Schedule B, and any others that apply to your situation. These documents provide necessary details for a comprehensive assessment of your tax liability.

- Do: Carefully calculate your West Virginia taxable capital and business franchise tax, ensuring to apply the correct rates and any applicable credits. Mistakes here can result in either underpayment or overpayment of taxes.

- Do: Utilize the direct deposit option for refunds to expedite the process. Ensure the banking information is current and correctly entered to avoid misdirected funds.

- Do: Review the entire form upon completion to confirm that all required fields are filled out and that the information provided is accurate and truthful.

- Do: Sign and date the form. An unsigned return is considered incomplete and will not be processed until properly signed, potentially incurring penalties for late filing.

- Don't: Leave any required fields blank. Incomplete forms can lead to delays in processing or might be considered invalid.

- Don't: Guess on figures or make estimations. Use exact amounts from your financial records to ensure the accuracy of your tax return.

- Don't: Overlook the importance of reporting all forms of income, including non-business income allocated to West Virginia for S Corporations or Partnership income. Omitting income can result in penalties and interest charges.

- Don't: Forget to apply for tax credits for which you are eligible, such as the business franchise tax credit or credits for investments in pollution control equipment. These can significantly reduce your tax liability.

- Don't: Mix personal information with business information on the form. Keep all reported data strictly related to the business entity.

- Don't: Miss the filing deadline. Late submission can lead to penalties, interest charges, and other unnecessary complications.

- Don't: Hesitate to seek professional advice if you encounter difficulties in completing the form. Accuracy on tax forms is crucial, and consulting with a tax professional can help avoid costly errors.

Misconceptions

Understanding the WV/SPF-100 form can sometimes be confusing, and there are a few misconceptions that can lead to misunderstandings. Here's a breakdown of some common ones:

It's only for big businesses: Some people think that the WV/SPF-100 form is only for large corporations. In reality, this form is required for S corporations and partnerships of all sizes operating in West Virginia, ensuring they comply with state tax laws related to income and business franchise taxes.

Filing is the same as for personal taxes: It's easy to assume that filing business taxes is just like filing your personal taxes, especially with the form's emphasis on pass-through income. However, businesses must navigate different rules for deductions, income allocation among states, and credits, making the process more complex than individual tax filing.

All income is taxable in West Virginia: There’s a misconception that all income reported on the WV/SPF-100 automatically subjects to West Virginia tax. The reality, however, involves an apportionment calculation to determine the share of multistate business income that's taxable in West Virginia, with specific rules for nonbusiness and apportioned income.

Nonresident withholding is optional: Some might think that withholding taxes for nonresident owners or members is optional. Actually, it's a requirement under specific conditions aimed at ensuring that nonresident individuals pay their fair share of taxes on income from West Virginia sources, as outlined in the form’s nonresident withholding section.

Amended returns aren’t a big deal: Amending a return might seem simple, akin to noting a few changes and sending it back. However, amended filings for the WV/SPF-100 require careful recalculations, may involve additional documentation, and could potentially trigger a closer review by tax authorities, indicating its seriousness.

Dispelling these misconceptions can help in accurately completing the WV/SPF-100 form and ensuring compliance with West Virginia's tax requirements for S corporations and partnerships.

Key takeaways

The WV SPF-100 form is tailor-made for S Corporations and Partnerships registered in West Virginia, providing a structured format to report income or business franchise tax obligations. This intricacy is central to ensuring that businesses comply with state tax regulations, affirming their commitment to fiscal responsibility within West Virginia.

When embarking on filling out the WV SPF-100, it is paramount to select the correct business type by checking the appropriate box for either S Corporation or Partnership. This preliminary step is crucial as it guides the subsequent sections and schedules that need to be completed, ensuring that the information provided aligns with the specific entity’s tax obligations.

Accuracy in reporting the Tax Year, including the beginning, ending, and if applicable, the extended due dates, cannot be overstated. These dates lay the groundwork for the tax period under review, impacting the calculation of tax dues and compliance with filing deadlines. A misstep here could lead to undesired scrutiny or penalties for late submissions.

Inclusion of the Federal Return (1120S for S Corporations and 1065 for Partnerships) is a necessity, acting as a companion document that complements the information provided on the WV/SPF-100. This requisite underscores the intertwined nature of federal and state tax reporting, facilitating a comprehensive assessment of the entity’s fiscal posture.

Understanding and accurately computing the various tax components, such as West Virginia taxable capital, business franchise tax, and withholding payments for nonresident shareholders or partners, are pivotal. These elements form the bedrock of the business’s tax liability, directing the calculation towards either a due payment to the state or a potential refund, further emphasizing the importance of precision in the initial stages of preparing this return.

Addressing modifications to federal income demands meticulous attention, as this process involves both additions and subtractions to reconcile federal taxable income with state tax obligations. This reconciliation is instrumental in arriving at the modified taxable income, a critical value that influences the apportionment and ultimately, the tax payable to West Virginia.

Finally, attaching the completed Schedule B and, where applicable, Schedule A-3 or Schedule A-2, is non-negotiable for furnishing a comprehensive submission. These schedules provide detailed insights into the business’s capital and adjustments thereof, mandatory for an accurate tax assessment. Neglecting to append these could not only invalidate the filing but potentially result in an unfavorable default tax assessment.

Popular PDF Forms

West Virginia Auto Insurance Requirements - The form must be filled out with accurate vehicle information including the make, model, and year to be processed correctly.

Wv 2848 - The form includes provisions for taxpayers to detail any other powers they wish to grant their representative that are not explicitly listed.

Wv Sales and Use Tax Form - Direct Pay Permits continue to be valid until surrendered or cancelled by the holder or the State Tax Department.