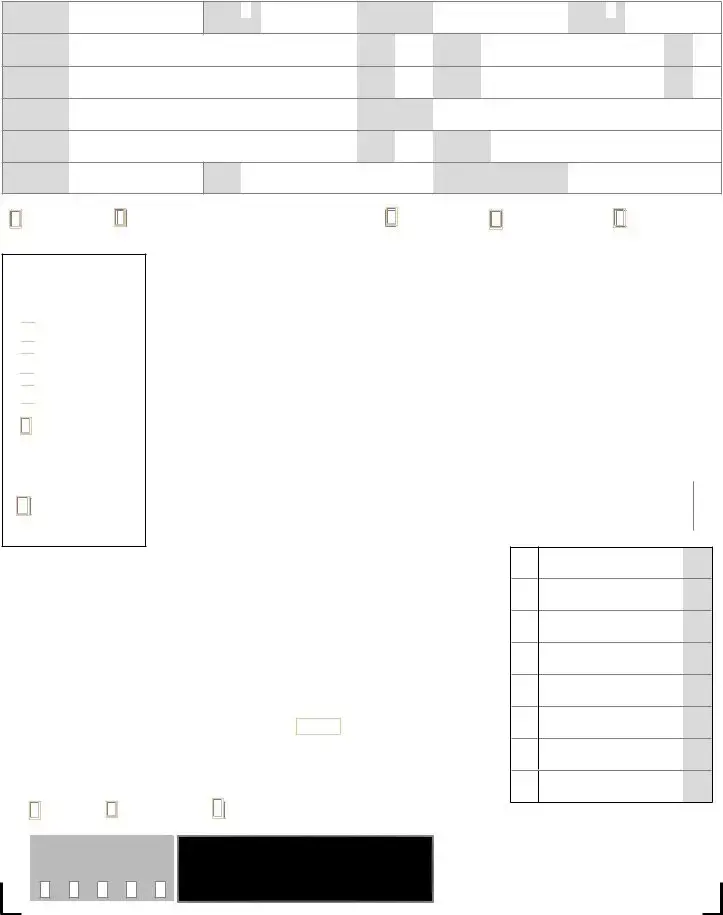

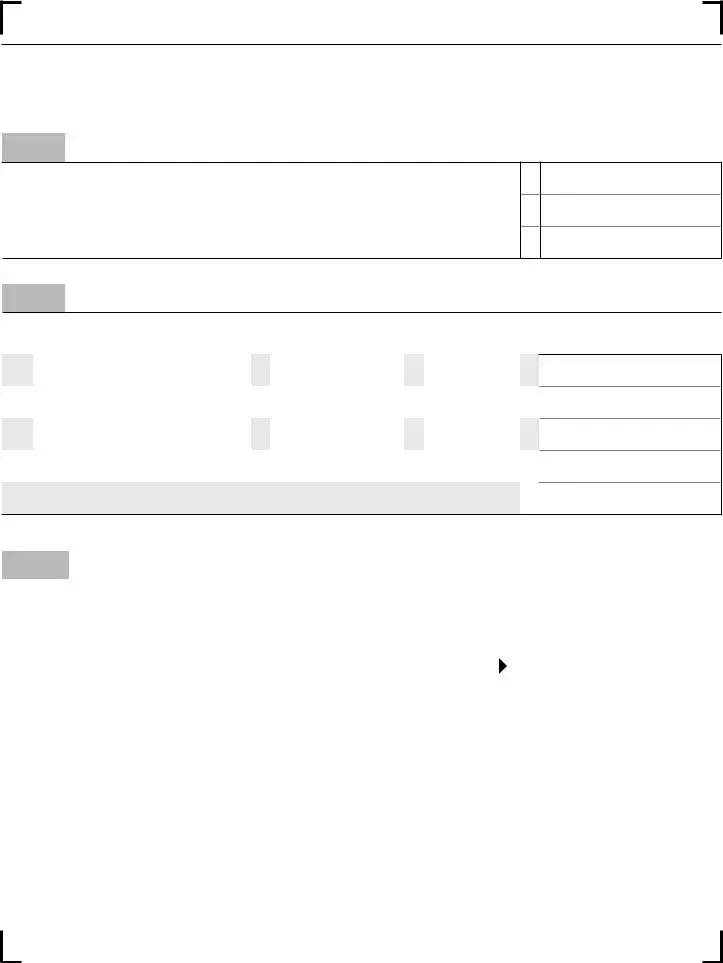

Fill Out a Valid Wv It 140 Form

Filing taxes can often feel overwhelming, but understanding the forms you're required to fill out is a great first step in demystifying the process. The WV IT-140 form, known as the West Virginia Personal Income Tax Return for the year 2020, is a comprehensive document designed for residents (and certain nonresidents/part-year residents) to report income, calculate their tax liability, and claim any eligible credits or adjustments. It begins with personal information including Social Security numbers, names, and contact details for both the filer and, if applicable, their spouse. Key sections cover filing status—such as single or married filing jointly—and exemptions, which reduce the amount of income considered taxable. Importantly, the form delves into financial details, requesting taxpayers to report their federal adjusted gross income and make specific additions or subtractions as dictated by West Virginia tax laws, ultimately arriving at their state taxable income. Tax due is determined via tables or schedules provided, with provisions for tax credits to reduce the amount owed. Additionally, for those who've overpaid, it outlines how refunds can be claimed or applied to future taxes; for others, it details payment options for any tax due. By itemizing these processes, the IT-140 form serves as a critical tool for individuals navigating the complexities of state income taxation, ensuring they meet their obligations while taking advantage of West Virginia's provisions for reducing their taxable income.

Sample - Wv It 140 Form

|

|

F |

WEST VIRGINIA PERSONAL INCOME TAX RETURN |

2021 |

|

|

|

|

REV |

|

|

SOCIAL

SECURITY

NUMBER

LAST NAME

SPOUSE’S

LAST NAME

FIRST LINE OF

ADDRESS

CITY

TELEPHONE

NUMBER

|

|

|

|

|

Deceased |

|

|

|

*SPOUSE’S |

|

|

|

|

|

|

Deceased |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Date of Death: |

|

|

|

|

|

|

Date of Death: |

|

|||||||||||||||||

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

SUFFIX |

|

|

|

FIRST |

|

|

|

|

|

|

|

|

|

|

|

MI |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

SUFFIX |

|

|

|

FIRST |

|

|

|

|

|

|

|

|

|

|

MI |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECOND LINE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

OF ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

WV |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXTENDED DUE DATE |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended |

return |

Check before 4/18/22 if you wish to stop the original debit (amended return only)

Nonresident Special

Nonresident/

Form

1

2

3

4

5

FILING

STATUS

(Check One)

Single

Single

Head of Household

Head of Household

Married, Filing Joint

Married, Filing Joint

Married, Filing

Separate

*Enter spouse’s SS# and name in the boxes above

Widow(er) with dependent child

|

|

|

|

|

Enter “1” in boxes a |

Yourself |

(a) |

0 |

|

Exemptions |

(If someone can claim you as a dependent, leave box (a) blank.) |

{ Spouse |

|

|

|||||

and b if they apply |

(b) |

|

|||||||

0 |

|||||||||

c. List your dependents. If more than five dependents, continue on ScheduleSche |

DPP on page 6. |

|

|

|

|

|

|||

First name |

|

Last name |

|

Social Security |

|

Date of Birth |

|

|

|

|

|

|

Number |

|

(MM DD YYYY) |

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. Additional exemption if surviving spouse (see page 17) |

Enter total number of dependents |

(c) |

|

0 |

Enter decedents SSN: ______________________ Year Spouse Died: _____________________ |

(d) |

0 |

||

|

|

|||

e. Total Exemptions (add boxes a, b, c, and d). Enter here and on line 6 below. If box e is zero, enter $500 on line 6 below. |

(e) |

0 |

||

|

|

|||

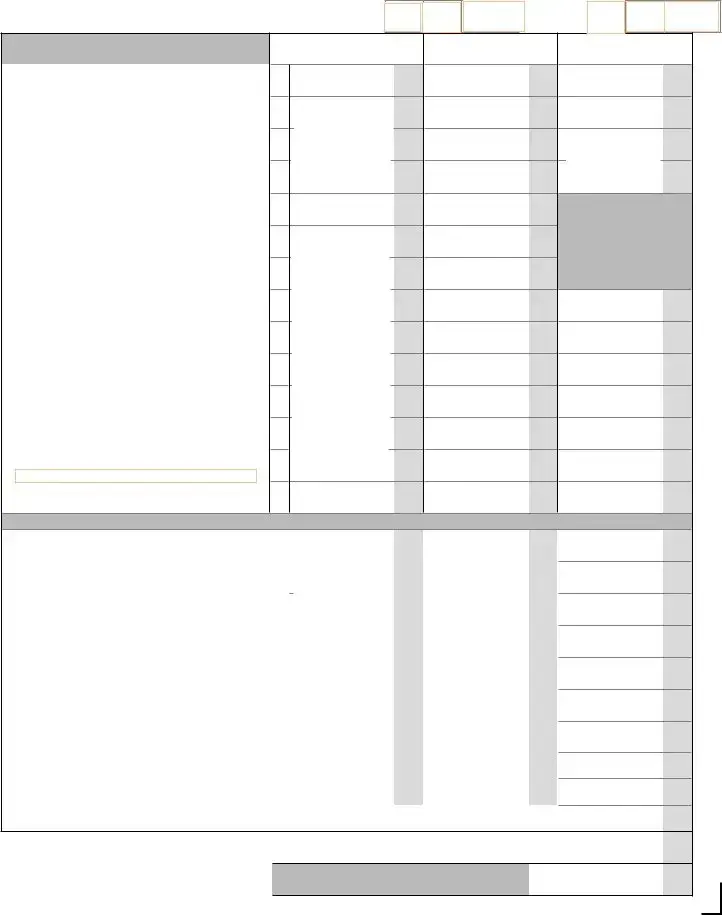

1.Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule

2.Additions to income (line 56 of Schedulele M).............................................................................................

3.Subtractions from income (line 48 of Schedulele M)....................................................................................

4.West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3)......................................................

5.

0

6. Total Exemptions as shown above on Exemption Box (e) ________ x $2,000 ........................................

7. West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO ............

8. |

Income Tax Due (Check One) |

||

|

Tax Table |

RateRateScheduleSchedule |

|

|

Tax Table |

Nonresident/PartN |

|

1

2

3

4

5

6

7

8

0.00

0.00

0.00

0.00

0.00

500.00

0.00

0.00

TAX DEPT USE ONLY

PAY COR SCTC NRSR HEPTC PLAN

MUST INCLUDE WITHHOLDING

FORMS WITH THIS RETURN

*P40202101F*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

1 |

F |

|

|

|

PRIMARY LAST NAME |

|

|

|

|

|

SOCIAL SECURITY |

|

|

|

|

|

|

|

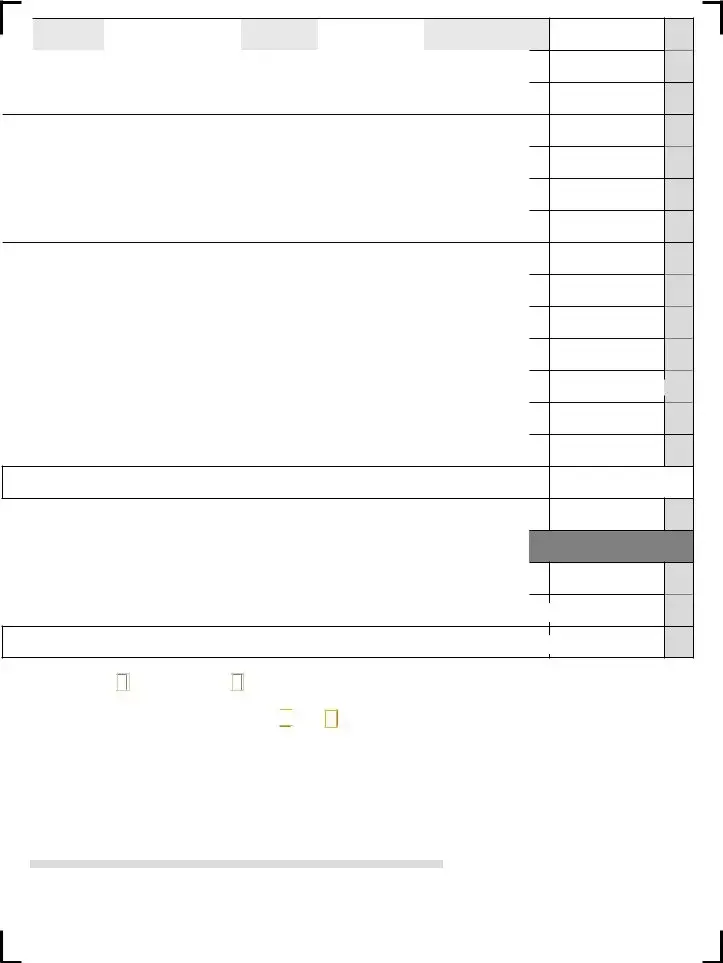

8.Total Taxes Due |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

SHOWN ON FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

|

(line 8 from previous page) |

8 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

Credits from Tax Credit Recap Schedule (see schedule on page 5 ) (now includes the Family Tax Credit) |

9 |

||||||||||||||||||

10. |

Line 8 minus 9. If line 9 is greater than line 8, enter 0 |

|

|

|

|

|

|

|

|

|

|

10 |

|||||||||

11. |

Overpayment previously refunded or credited (amended return only) |

|

|

|

|

|

|

|

|

|

11 |

||||||||||

12. |

Penalty Due from Form |

|

CHECK IF REQUESTING WAIVER/ANNUALIZED |

12 |

|||||||||||||||||

|

|||||||||||||||||||||

|

WORKSHEET ATTACHED |

|

|

|

|

If you owe penalty, enter here |

|||||||||||||||

13. |

West Virginia Use Tax Due on |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(See ScScheduleuleUTUT on page 9). |

|

|

|

|

|

|

|

|

CHECK IF NO USE TAX DUE |

13 |

|||||||||

14. |

..................................................................................Add lines 10 through 13. This is your total amount due |

|

|

|

|

|

|

|

|

|

14 |

||||||||||

15. |

West Virginia Income Tax Withheld (See instructions) |

|

|

Check if withholding from NRSR |

15 |

||||||||||||||||

|

|

||||||||||||||||||||

|

|

(Nonresident Sale of Real Estate) |

|||||||||||||||||||

16. |

.......................................................................Estimated Tax Payments and Payments with Schedule 4868 |

|

|

|

|

|

|

|

|

|

16 |

||||||||||

17. |

17 |

||||||||||||||||||||

18. |

Senior Citizen Tax Credit for property tax paid (include Schedule |

.................................................. |

|

|

|

|

|

18 |

|||||||||||||

19. |

.......................Homestead Excess Property Tax Credit for property tax paid (include Schedule |

19 |

|||||||||||||||||||

20. |

Amount paid with original return (amended return only) |

|

|

|

|

|

|

|

|

|

20 |

||||||||||

21. |

Payments and Refundable Credits (add lines 15 through 20) |

|

|

|

|

|

|

|

|

|

21 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

22. |

Balance Due (line 14 minus line 21). If Line 21 is greater than line 14, complete line 23 |

..... |

PAY THIS AMOUNT |

|

22 |

||||||||||||||||

|

|

|

|

||||||||||||||||||

23. |

Line 21 minus line 14. This is your overpayment |

|

|

|

|

|

|

|

|

|

23 |

||||||||||

24. |

Donations of part or all of line 23. Indicate below and enter the sum of columns 24A, 24B, and 24C on Line 24 |

||||||||||||||||||||

|

|

|

24A. WEST VIRGINIA |

|

|

24B. WEST VIRGINIA DEPARTMENT |

|

|

|

24C. DONEL C. KINNARD MEMORIAL |

|

||||||||||

|

|

|

CHILDREN’S TRUST FUND |

|

|

OF VETERANS ASSISTANCE |

|

|

|

STATE VETERANS CEMETERY |

|

||||||||||

|

|

|

|

|

0 |

|

|

|

|

0 |

|

|

0 |

|

|

24 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

Amount of Overpayment to be credited to your 2022 estimated tax |

............................................................... |

|

|

|

|

|

|

|

|

|

25 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

26. |

Refund due to you (line 23 minus line 24 and line 25) |

|

|

|

|

|

|

REFUND |

|

26 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Direct Deposit |

|

|

|

|

|

of Refund |

CHECKING |

SAVINGS |

|

|

|

|

|

|

ROUTING NUMBER |

|

ACCOUNT NUMBER |

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

I authorize the State Tax Department to discuss my return with my preparer

YES

YES

NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Your Signature |

|

|

Date |

Spouse’s Signature |

Date |

Telephone Number |

||||

|

|

Preparer: Check |

|

|

|

|

|

|

|

|

|

|

HERE if client is |

|

|

|

|

|

|

|

|

|

|

requesting that form |

|

|

|

|

|

|

|

|

|

|

NOT be |

|

|

|

|

|

|

|

|

|

Preparer’s EIN |

Signature of preparer other than above |

Date |

Telephone Number |

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Preparer’s Printed Name |

|

|

Preparer’s Firm |

|

|

|||||

|

|

|

FOR REFUND, MAIL TO THIS ADDRESS: |

|

FOR BALANCE DUE, MAIL TO THIS ADDRESS: |

|

|

|||

|

|

|

WV STATE TAX DEPARTMENT |

|

|

WV STATE TAX DEPARTMENT |

|

|

||

|

|

|

|

P.O. BOX 1071 |

|

|

P.O. BOX 3694 |

|

|

|

|

|

|

CHARLESTON, WV |

|

|

CHARLESTON, WV |

|

|

||

Payment Options: Returns filed with a balance of tax due may pay through any of the following methods:

•Check or Money Order payable to the WV State Tax Department - Enclose check or money order with your return.

•Electronic Payment - May be made by visiting mytaxes.wvtax.gov and clicking on “Pay Personal Income Tax”.

•Credit Card Payment – May be made by visiting the Treasurer’s website at: epay.wvsto.com/tax

*P40202102F*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

2 |

F |

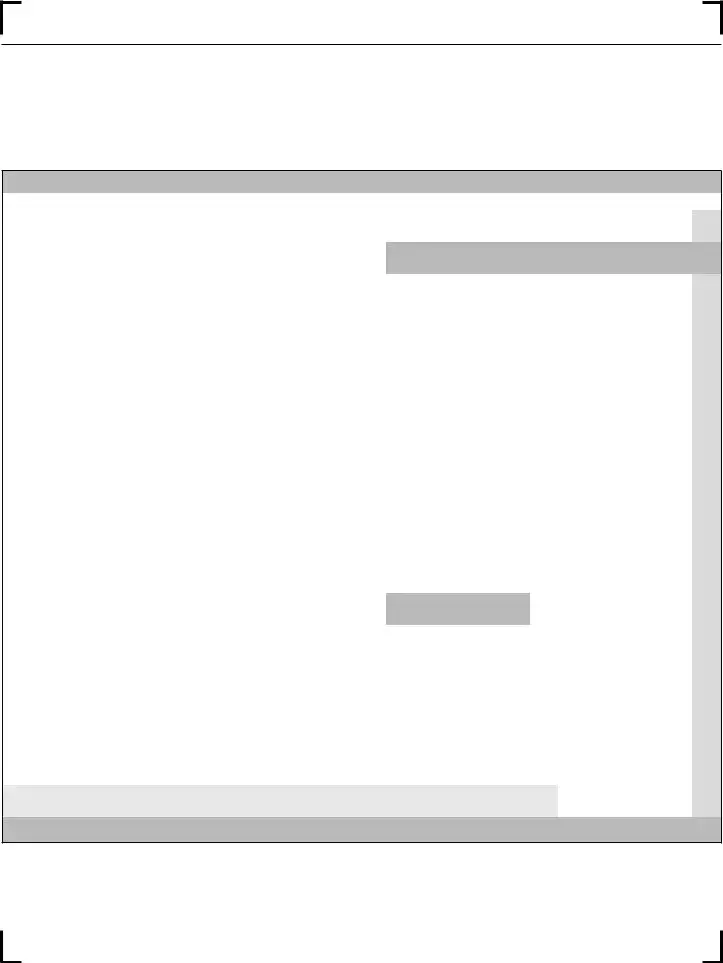

Schedule

Form

M F MODIFICATIONS TO ADJUSTED GROSS INCOME 2021

|

Modifications Decreasing Federal Adjusted Gross Income |

|

|

|

|

|

|

Column A (You) |

|

|

|

|

Column B (Spouse) |

||||||||||||||||||||||||||||||

|

27. |

Interest or dividends received on United States or West Virginia obligations, or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

allowance for government obligation income, included in federal adjusted gross income |

27 |

|

|

0 |

|

|

|

.00 |

|

0 |

|

|

|

.00 |

||||||||||||||||||||||||||

|

|

|

but exempt from state tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

28. |

Total amount of any benefit (including survivorship annuities) received from certain |

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

federal retirement systems by retired federal law enforcement officers |

|

|

0 |

|

|

|

.00 |

|

|

0 |

|

|

.00 |

|||||||||||||||||||||||||||

|

29. |

Total amount of any benefit (including survivorship annuities) received from WV state |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

or local police, deputy sheriffs’ or firemen’s retirement system, Excluding PERS |

0 |

|

|

|

.00 |

0 |

|

|

|

.00 |

||||||||||||||||||||||||||||||

|

|

|

page 22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

30. |

Military Retirement Modification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

0 |

|

.00 |

|

|

|

0 |

|

|

|

.00 |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. |

Other Retirement Modification |

|

|

|

Column A (You) |

|

|

|

Column B (Spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

(a) West Virginia Teachers’ and |

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

Public Employees’ Retirement |

|

|

|

|

.00 |

|

.00 |

|

|

|

|

Add lines 31 (a) and (b). If that sum is greater than $2000, enter $2000 |

||||||||||||||||||||||||||||

|

(b)Federal Retirement Systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

(Title 4 USC §111) |

|

|

|

|

|

|

|

|

|

0 |

|

.00 |

|

|

0 |

|

.00 |

31 |

|

|

|

|

|

|

|

.00 |

|

|

|

.00 |

||||||||||

|

32. |

Social Security Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

0 |

|

.00 |

0 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

(a) TOTAL Social Security Benefits. |

|

|

|

|

|

|

|

|

|

You cannot claim this modification if your Federal AGI exceeds |

||||||||||||||||||||||||||||||||

|

(b) Benefits exempt for Federal tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 50,000 for SINGLE or MARRIED SEPARATE filers |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$100,000 for MARRIED JOINT filers |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

purposes |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

.00 |

|

|

0 |

|

.00 |

|

|

|

|

Multiply 32 (c) by 0.65 |

|

|

|

|

|

|

|

|

|

|

||||||

|

(c) Benefits taxable for Federal tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

purposes (line a minus line b) |

|

|

|

|

|

.00 |

0 |

|

.00 |

32 |

|

|

|

|

|

.00 |

|

|

|

|

.00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

.00 |

|

0 |

|

|

|

.00 |

|||

|

33. |

Certain assets held by subchapter S Corporation bank |

.................................................. |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

34. |

Active Duty Military pay for personnel with West Virginia Domicile |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

34 |

|

|

|

0 |

|

|

|

.00 |

|

|

|

0 |

|

|

|

.00 |

|||||||||||||||||||||||||

|

|

|

(See instructions on page 22) |

........................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

35. |

Active Military Separation (see instructions on page 22) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

35 |

|

|

|

0 |

|

|

|

.00 |

|

|

|

0 |

|

|

|

.00 |

||||||||||||||||||||

|

|

|

Must enclose military orders and discharge papers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

36. |

Refunds of state and local income taxes received and reported as income to the IRS ... |

36 |

|

0 |

|

|

|

.00 |

0 |

|

|

|

.00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

37. |

Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds |

|

|

|

0 |

|

|

|

.00 |

|

0 |

|

|

|

.00 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

.00 |

||

|

38. |

Railroad Retirement Board Income received |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

0 |

|

|

|||||||||||||||||||||

|

.................................................................. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

39. |

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

0 |

|

|

|

.00 |

|

0 |

|

|

.00 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

40. |

IRC 1341 Repayments |

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

0 |

|

|

|

.00 |

|

0 |

|

|

.00 |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

41. |

Autism Modification (instructions on page 22) |

|

|

|

|

|

|

41 |

|

0 |

|

|

|

.00 |

0 |

|

|

.00 |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

42. |

ABLE Act |

....................................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

0 |

|

|

|

.00 |

0 |

|

|

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

43. |

PBGC Modification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

0 |

.00 |

0 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

(a) retirement benefits that would have been |

|

|

|

|

|

|

|

|

|

Subtract line 43 (b ) from (a) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

paid from your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

(b) retirement benefits actually received |

|

|

|

0 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

.00 |

|

|

.00 |

43 |

|

|

|

|

|

|

|

|

.00 |

|

0 |

|

|

.00 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

from PBGC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

44. |

Qualified Opportunity Zone business income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

44 |

0 |

|

|

|

.00 |

|

0 |

|

|

|

.00 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Year of |

birth |

(b) |

Year |

of |

(c) Income not included in |

(d) Add lines 27 through 32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

45. |

|

(65 or older) |

|

|

|

disability |

|

lines 33 to 44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtract line 45 column (d) from (c) (If less than zero, enter zero) |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(NOT TO EXCEED $8000) |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

You |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

.00 |

|

0 |

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

.00 |

|

0 |

|

.00 |

45 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46. Surviving spouse deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

*P40202103F* |

46 |

|

|

|

|

0 |

|

|

|

.00 |

|

0 |

|

|

|

.00 |

||||||||||||||||||||||||

|

|

|

Continues on next page |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(instructions on page 23) |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Modifications Decreasing Federal Adjusted Gross Income |

|

|

|||||||||||||||||||||||

|

|

|

|

P |

4 |

0 |

2 |

0 |

2 |

1 |

|

0 |

3 |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Schedule

Form

M F MODIFICATIONS TO ADJUSTED GROSS INCOME 2021

Modifications Decreasing Federal Adjusted Gross Income |

Column A (You) |

Column B (Spouse) |

|

|

|

47 |

|

|

.00 |

47. Add lines 27 through 46 for each column |

|

0 |

||||

|

|

48 |

|

|

|

|

48.Total Subtractions (line 47, Col A plus line 47,Col B) Enter here and on line 3 of |

Form |

|

|

|

|

|

FORM |

|

|

|

|

||

|

|

|

|

|

|

|

0.00

0.00

Modifications Increasing Federal Adjusted Gross Income |

|

|

49. |

Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax |

49 |

50. |

Interest or dividend income on state and local bonds other than bonds from West Virginia sources |

50 |

51. |

Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax |

51 |

52. |

Qualifying 402(e) |

52 |

53. |

Other income deducted from federal adjusted gross income but subject to state tax |

53 |

54. |

Withdrawals from a WV Prepaid Tuition/Savings Plan Trust Funds NOT used for payment of qualifying expenses |

54 |

55. |

ABLE ACT withdrawals not used for qualifying expenses |

55 |

|

Form |

|

56.TOTAL ADDITIONS (Add lines 49 through 55). Enter here and on Line 2 of Form |

56 |

|

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

*P40202104F*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

4 |

F |

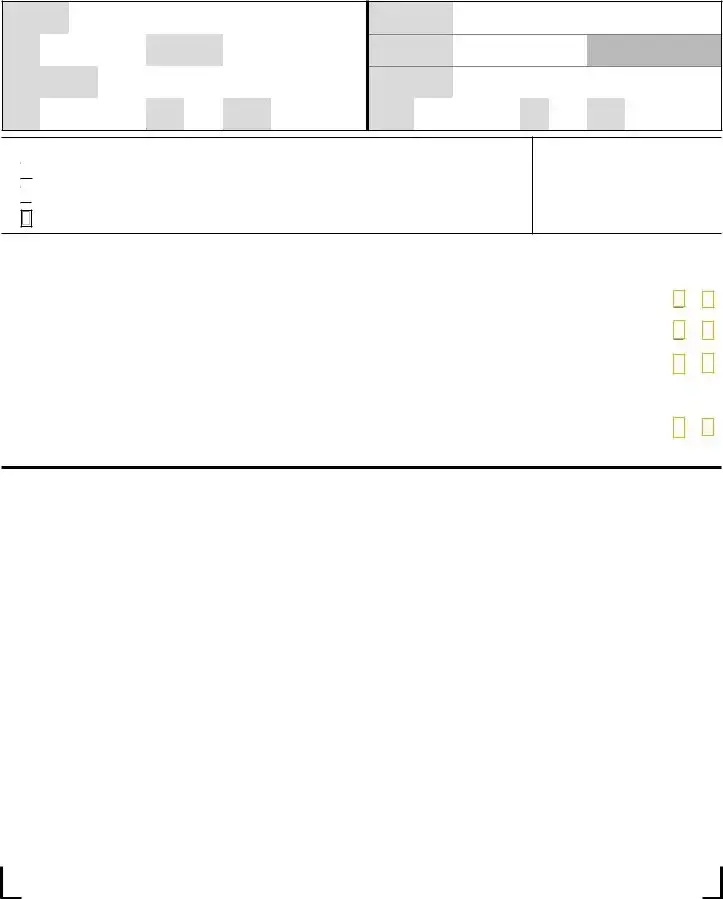

RECAP |

B |

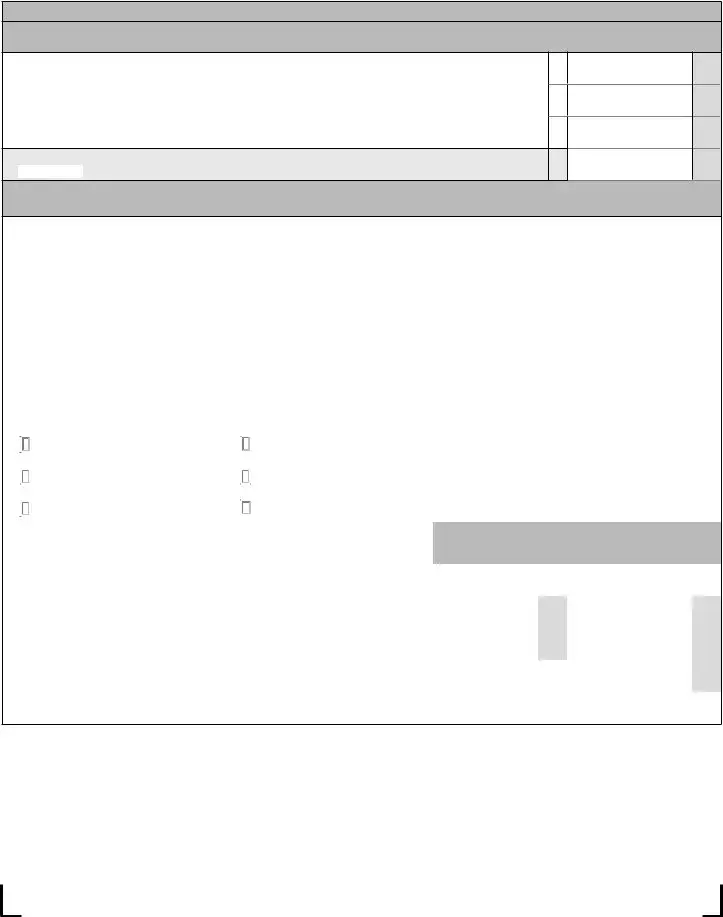

TAX CREDIT RECAP SCHEDULE |

2021 |

Form |

This form is used by individuals to summarize tax credits that they claim against their personal income tax. In addition to completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Both this sum- mary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED with your return in order to claim a tax credit. Information for all of these tax credits may be obtained by visiting our website at tax.wv.gov or by calling the Taxpayer Services Division at

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit you are no longer required to enclose the other state(s) return(s) or the

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

|

|

TAX CREDIT |

|

SCHEDULE |

APPLICABLE CREDIT |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

0 |

|

|

|

|

|

1. |

................................................Credit for Income Tax paid to another state(s) |

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||

** For what states? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

||||||

2. |

....................................................................Family Tax Credit (see page 39) |

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WV |

3 |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3. |

General Economic Opportunity Tax Credit |

|

|

|

|

0 |

|

|

.00 |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WV |

4 |

|

|

|

|

|

|

|

|

|

|

||||||||||||

4. |

WV Environmental Agricultural Equipment Credit |

|

|

|

|

|

0 |

|

|

.00 |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

5 |

|

|

|

|

|

|

|

|

|

|

|||||||||||

5. |

WV Military Incentive Credit |

|

|

|

|

|

|

0 |

|

|

.00 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|||||||||||||

6. |

Neighborhood Investment Program Credit |

|

|

|

0 |

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

||||||||||||

7. |

Historic Rehabilitated Buildings Investment Credit |

|

|

|

RBIC |

|

|

0 |

|

|

.00 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

||||||||||||||

8. |

Qualified Residential Rehabilitated Buildings Investment Credit |

|

|

|

0 |

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|||||||||||||||

9. |

Apprenticeship Training Tax Credit |

|

WV |

|

0 |

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

||||||||||||||

10. |

|

|

|

0 |

|

|

.00 |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

||||||||||||||

11. |

Conceal Carry Gun Permit Credit |

|

|

|

|

0 |

|

|

.00 |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|||||||||||||

12. Farm to Food Bank Tax Credit |

|

|

|

|

|

|

|

0 |

|

|

.00 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

||||||||||||||||

13. |

Downstream Natural Gas Manufacturing Investment Tax Credit |

|

|

DNG- 2 |

|

0 |

|

|

.00 |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|||||||||||||||||

14. |

Post Coal Mine Site Business Credit |

|

|

|

0 |

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

.......................................................................................Natural Gas Liquids |

|

|

15 |

0 |

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

Donation or Sale of Vehicle to Qualified Charitable Organizations |

|

|

16 |

0 |

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Small Arms And Ammunition Manufacturers Credit |

|

|

17 |

0 |

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18.TOTAL CREDITS — add lines 1 through 17. Enter on Form |

|

|

|

|

18 |

0 |

|

|

.00 |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**You cannot claim credit for taxes paid to KY, MD, PA, OH, or VA unless your source income is other than wages and/or salaries.

*P40202105A*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

5 |

A |

|

|

Schedule |

|

STATEMENT OF CLAIMANT |

2021 |

|

|

|

F |

F |

TO REFUND DUE DECEASED TAXPAYER |

|

|

|

|

|||||

|

|

Form |

|

Attach completed schedule to decedent’s return

NAME OF

DECEDENT

DATE OF |

|

|

|

|

SOCIAL SECURITY |

|

|

|

|

|

|

DEATH |

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ADDRESS |

|

|

|

|

|

|

|

|

|||

(permanent residence or |

|

|

|

|

|

|

|

|

|||

domicile at date of death) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

STATE |

|

|

ZIP |

|

|

||

|

|

|

CODE |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF

CLAIMANT

SOCIAL SECURITY

NUMBER

ADDRESS

CITY |

|

STATE |

WV |

ZIP |

|

|

CODE |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

I am filing this statement as (check only one box):

A. Surviving wife or husband, claiming a refund based on a joint return

Surviving wife or husband, claiming a refund based on a joint return

B. Administrator or executor. Attach a court certificate showing your appointment.

Administrator or executor. Attach a court certificate showing your appointment.

C.Claimant for the estate of the decedent, other than above. Complete the rest of this schedule and attach a copy of the death certificate or proof of death*

ATTACH A LIST TO THIS SCHED-

ULE CONTAINING THE NAME AND ADDRESS OF THE SURVIV- ING SPOUSE AND CHILDREN OF THE DECEDENT.

TO BE COMPLETED ONLY IF BOX C ABOVE IS CHECKED

YES NO

1. Did the decedent leave a will?....................................................................................................................................................................

2(a).Has an administrator or executor been appointed for the estate of the decedent?......................................................................................

2(b) If "NO" will one be appointed?......................................................................................................................................................................

If 2(a) or 2(b) is checked "YES", do not file this form. The administrator or executor should file for the refund.

3.Will you, as the claimant for the estate of the decedent, disburse the refund according to the laws of the state in which the decedent

was domiciled or maintained a permanent residence?.................................................................................................................................

If "NO", payment of this claim will be withheld pending submission of proof of your appointment as administrator or execu- tor or other evidence showing that you are authorized under state law to receive payment.

SIGNATURE AND VERIFICATION

I hereby make request for refund of taxes overpaid by, or on behalf of the decedent and declare under penalties of perjury, that I have examined this claim and to the best of my knowledge and belief, it is true, correct and complete.

Signature of claimant _____________________________________________________ Date _______________________________

*May be the original of an authentic copy of a telegram or letter from the Department of Defense notifying the next of kin of death while in active service, or a death certificate issued by the appropriate officer of the Department of Defense.

*P40202116F*

P |

4 |

0 |

2 |

0 |

2 |

1 |

1 |

6 |

F |

Schedule

Form

UT F WEST VIRGINIA PURCHASER’S USE TAX SCHEDULE 2021

INSTRUCTIONS

Purchaser’s Use Tax is a tax on the use of tangible personal property or services in West Virginia where Sales Tax has not been paid. Use Tax applies to the following: internet purchases, magazine subscriptions,

For detailed instructions on the Schedule UT, see page 10.

Part I State Use Tax Calculation

1.Amount of purchases subject to West Virginia Use Tax.................................................................................

2.West Virginia Use Tax Rate..........................................................................................................................

3.West Virginia State Use Tax (Multiply line 1 by rate on line 2. Enter amount here and on line 9 below).......

1

2

3

$0.00

.06

$0.00

Part II Municipal Use Tax Calculation

City/Town Name* |

Purchases Subject to |

Tax Rate |

Municipal Tax Due |

|

Municipal Use Tax |

(Purchases multiplied by rate) |

|||

|

|

4a |

|

|

|

4b |

$ |

|

0.00 |

|

4c |

|

|

|

|

4d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a |

|

|

|

5b |

$ |

|

0.00 |

|

5c |

|

|

|

|

5d |

|

|

|

|

|

|

|

|

|

||||||

|