Fill Out a Valid Wv Frm 01 Form

Amid the regulatory requirements that govern the wine industry in West Virginia, the WV Frm 01 form plays a crucial role for licensed farm wineries. Drafted by the State Tax Department, this document serves as a production report that every licensed farm winery must submit annually. The form is designed to capture the total gallonage of wine produced or blended by the winery over a twelve-month period ending June 30 of each year, or for any part of the year the winery was in operation. It is essential for compliance with West Virginia Legislative Regulations, Title 175, Series 3-4.11, which mandates this reporting. Notably, the WV Frm 01 form has undergone updates to ensure its alignment with the State Tax Department’s new computer system, highlighting the importance of using the current version of the form to avoid processing delays. The form allows for monthly reporting of production quantities, which should align with the figures reported on ATF Form 702, Part 1, Line 2, offering flexibility and convenience for wineries in managing their reporting obligations. With sections detailing total production, the form also includes areas for the winery’s basic information and a certification section that requires the signature of the taxpayer, asserting the report's accuracy under penalty of perjury. This comprehensive approach to reporting underscores the State of West Virginia's commitment to maintaining an accurate and updated database of wine production within the state, facilitating both regulatory compliance and statistical analysis of the industry's contributions to the local economy.

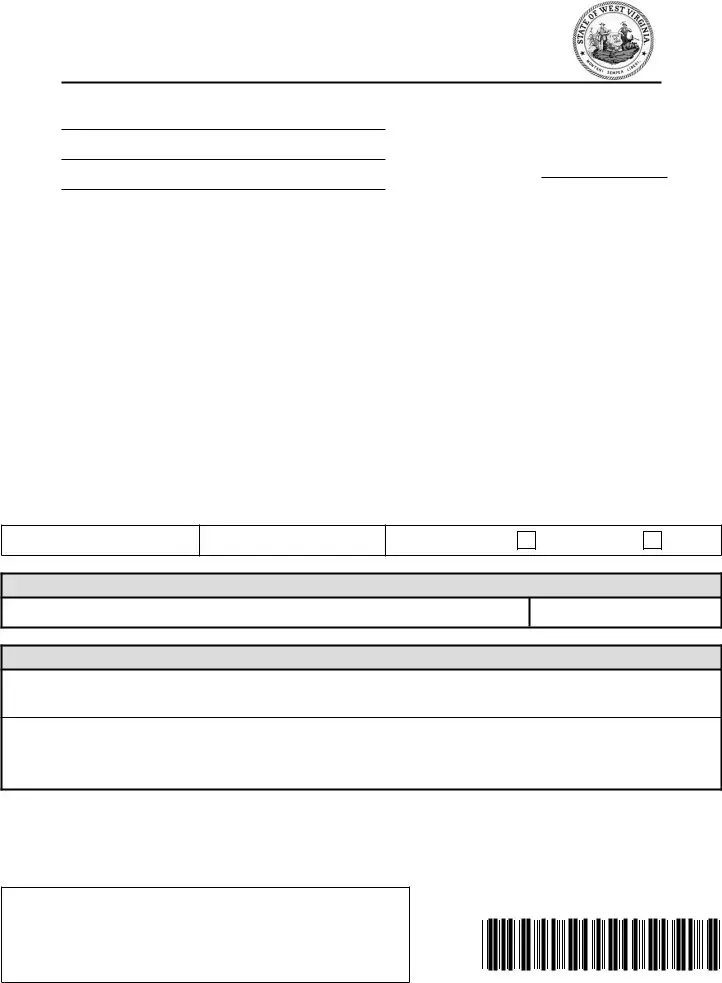

Sample - Wv Frm 01 Form

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 2991

Charleston, WV

Earl Ray Tomblin, Governor |

Craig A. Griffith, Tax Commissioner |

Name

Address

Account #:

City |

State |

Zip |

WEST VIRGINIA LICENSED FARM WINERIES PRODUCTION REPORT

NOTE: This return has been redesigned. To avoid delays in the processing of this return, DO NOT use any older forms you may have. For information regarding the State Tax Department’s new computer system, visit our website at www.wvtax.gov

This report must be filed even if no activity has occurred

West Virginia Legislative Regulations, Title 175, Series 3

(12)month period ending June 30 of each year or partial year. Such report shall be submitted by letter report within thirty (30) days after the end of such fiscal year."

For your convenience, the information may be reported monthly. Information contained on this form should show the same quantities as ATF Form 702, Part 1, Line 2.

Period Ending:

Due Date:

FINAL

AMENDED

TOTAL PRODUCTION

GALLONS OF WINE PRODUCED BY FERMENTATION

.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true and complete.

(Signature of Taxpayer) |

(Name of Taxpayer - Type or Print) |

(Title) |

(Date) |

|

|

|

|

(Person to Contact Concerning this Return) |

(Telephone Number) |

|

|

|

|

|

|

(Signature of preparer other than taxpayer) |

(Address) |

|

(Date) |

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT |

|

|

|

|

|

|

|

|

|

|

Tax Account Administration Div |

|

|

|

|

|

|

|

|

|

|

P.O. Box 2991, Charleston, WV |

|

|

|

|

|

|

|

|

|

|

FOR ASSISTANCE CALL (304) |

|

|

|

|

|

|

|

|

|

|

For more information visit our web site at: www.wvtax.gov |

|

|

|

|

|

|

|

|

|

|

File online at https://mytaxes.wvtax.gov |

O |

3 |

5 |

0 |

2 |

0 |

9 |

0 |

1 |

W |

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used by licensed farm wineries in West Virginia to report their total production of wine. |

| Reporting Requirement | Every licensed farm winery must report its total gallonage of wine produced or blended for the twelve-month period ending June 30 of each year or partial year within thirty days after the fiscal year ends. |

| Governing Law | West Virginia Legislative Regulations, Title 175, Series 3 - 4.11, govern the reporting requirements for this form. |

| Filing Frequency | While the annual report is mandatory, wineries have the convenience to submit this information monthly. |

Guide to Using Wv Frm 01

Filing the WV FRM 01 form is a necessary step for licensed farm wineries in West Virginia to report their annual production. This process ensures compliance with state tax regulations and helps maintain accurate records. The form requires details on wine production, and it's crucial to submit it timely to avoid any processing delays. Let's walk through the steps required to complete this form correctly.

- First, visit the official website of the West Virginia State Tax Department to ensure you have the latest version of the WV FRM 01 form. Using an outdated version can lead to processing delays.

- Read the note at the top of the form carefully to understand the importance of using the current form.

- Enter the name of the taxpayer in the "Name" field.

- Fill in the address information, including city, state, and zip code, in the designated spaces.

- Proceed to enter the Account Number in the provided "Account #:" space. This ensures your report is correctly filed under your farm winery's account.

- Under "WEST VIRGINIA LICENSED FARM WINERIES PRODUCTION REPORT," indicate the period ending and due date as specified for your reporting cycle.

- In the "TOTAL PRODUCTION GALLONS OF WINE PRODUCED BY FERMENTATION" section, report the total gallonage of wine produced or blended within the specified period.

- Review the statement regarding the penalty of perjury at the bottom of the form, confirming the accuracy and completeness of the information provided.

- Sign the form in the "Sign Your Return" section. If you are the taxpayer, provide your signature, printed name, title, and the date. If someone other than the taxpayer is preparing the form, they must also sign, print their name, provide their address, and date their signature.

- Include the contact information of the person to be contacted concerning this return, including their telephone number and email address.

- Double-check all entries to ensure accuracy and completeness.

- Mail the completed form to the West Virginia State Tax Department at the address provided on the form: Tax Account Administration Div, P.O. Box 2991, Charleston, WV 25330-2991. Alternatively, see if online filing is an option through the link provided on the form.

- If you have any questions or need assistance, use the contact information provided on the form to reach out for help.

Following these steps will help ensure that your WV FRM 01 form is filled out accurately and submitted properly. Remember to report your winery's production annually and to keep a copy of the submitted form for your records.

Essential Points on Wv Frm 01

What is the WV Frm 01 form?

The WV Frm 01 form is an official document issued by the State of West Virginia Tax Department for licensed farm wineries within the state. It serves as a production report that farm wineries are required to submit, detailing their total gallonage of wine produced or blended. The form collects information on wine production for the twelve-month period ending June 30 of each year, or a partial year, if applicable. Submission of this report is mandatory for all licensed farm wineries, ensuring they comply with West Virginia Legislative Regulations, Title 175, Series 3 - 4.11. The form has been redesigned to facilitate processing, and wineries are advised to use the latest version of the form for submission.

When is the WV Frm 01 form due?

For each fiscal year ending on June 30, the WV Frm 01 form must be submitted within 30 days after the fiscal year's end. This means that the due date for submitting the form is on or before July 30 annually. However, the state allows for monthly reporting for the convenience of the wineries. It is crucial for wineries to adhere to this deadline to ensure compliance with state regulations and avoid any processing delays.

Where should I send the completed WV Frm 01 form?

Completed WV Frm 01 forms should be mailed to the West Virginia State Tax Department, Tax Account Administration Division, at P.O. Box 2991, Charleston, WV 25330-2991. For individuals who prefer or require assistance, the department can be contacted through phone numbers provided on the form. Alternatively, the form and additional documentation can be filed online through the State Tax Department’s website.

What information is required on the WV Frm 01 form?

The form requires detailed information about the wine production activities of the licensed farm winery. Specific information requested includes the total gallons of wine produced by fermentation during the report period. It is expected that the quantities reported on the WV Frm 01 form match those on ATF Form 702, Part 1, Line 2. Additionally, signature areas are provided for both the taxpayer and, if applicable, the preparer other than the taxpayer, alongside their respective contact information. The form also requires the inclusion of the winery’s account number and the period the report covers.

What happens if no activity occurred during the reporting period?

Even if no wine production activity occurred during the reporting period, licensed farm wineries are still required to file the WV Frm 01 form. This zero-activity report ensures compliance with West Virginia’s regulations for licensed farm wineries. Filing the report, despite having no production, is crucial for maintaining accurate and current records with the State Tax Department. It is a simple yet essential step in adhering to the state's legislative requirements for licensed farm wineries.

Common mistakes

Filling out government forms can be complicated and the WV FRM 01 form is no exception. People often make mistakes that could lead to processing delays or even the denial of their request. Being aware of these common errors can help in preparing this form correctly.

- Not using the updated form: The state occasionally updates its forms to improve clarity or capture additional needed information. One common mistake is using an older version of the WV FRM 01 form, which can cause delays.

- Incomplete information: Some sections may seem irrelevant or unnecessary to the person filling out the form, but leaving sections blank can result in processing delays. Every question that applies must be answered thoroughly.

- Incorrect totals: It's crucial to ensure that the total gallons of wine produced match the quantities reported on ATF Form 702, Part 1, Line 2. Mismatches can lead to questions or audits.

- Mistakes in personal information: Even simple errors in typing names, addresses, or account numbers can lead to significant problems. Care should be taken to ensure accuracy.

- Not reporting monthly: While it's possible to report annually, the WV FRM 01 form allows for monthly reporting, which can make data management easier and prevent year-end errors.

- Forgetting to sign: The form requires a signature under penalties of perjury. Forgetting to sign can invalidate the entire submission.

- Overlooking the option to file online: Many people are unaware that this form can be filed online, which is not only more convenient but also reduces the risk of errors.

- Not seeking help when needed: With contact information provided on the form, assistance is readily available, yet many overlook this resource and proceed with uncertainties.

- Filing late: Adhering to the due date is critical. Late submissions can lead to penalties or fines.

- Not checking for amendments: If any information changes after initial submission, an amended form must be filed. Failing to do so can lead to inaccuracies in records.

Many of these mistakes stem from a lack of attention to detail or a misunderstanding of the form's requirements. It is always a good idea to review all entered information and consult the provided resources or seek assistance if any confusion arises. This helps to ensure that the submission process is as smooth and error-free as possible.

Submitting the WV FRM 01 form accurately is important for compliance with West Virginia's tax and regulatory requirements. By taking the time to fully understand and correctly complete this form, individuals can avoid common pitfalls, helping ensure their report is processed efficiently and accurately.

Documents used along the form

When managing or establishing a licensed farm winery in West Virginia, the WV FRM-01 form serves as a critical document for reporting the total gallonage of wine produced. However, to ensure comprehensive compliance and to facilitate various regulatory and operational aspects, several other forms and documents are often utilized alongside the WV FRM-01. Understanding these additional documents can simplify the processes for tax and production reporting, licensing, and other legal requirements related to the winery business.

- ATF Form 702: Known as the “Report of Wine Premises Operations,” this federal form aligns with the WV FRM-01 in reporting production quantities. It's imperative for wineries to maintain consistency between the two documents to ensure accurate reporting of wine production and blending activities to both state and federal authorities.

- WV ABD-1: This is the initial application form required for obtaining a license to operate a farm winery in West Virginia. It collects detailed information about the business and its principals, providing the state with necessary background for regulatory approval.

- WV CS-905: The Personal Property Tax Form, required annually by the West Virginia State Tax Department, helps in assessing the value of tangible assets owned by the winery. This would include production equipment, storage tanks, and other physical assets used in wine production.

- WV LWF: The Local Wine Fee Return form is designed for reporting and remitting any local fees that might be applicable to wineries based on their production levels or sales. Local fees can vary by county or city, and this form ensures compliance with local tax ordinances.

- Winery Incident Report: While not a standard form, maintaining records of any incidents or accidents on the winery premises is critical for legal and insurance purposes. This can include injuries, production errors, or equipment malfunctions. Documenting these incidents thoroughly supports better management and regulatory compliance.

Collectively, these documents form the backbone of a detailed regulatory and operational framework for licensed farm wineries in West Virginia. Proper management of these forms ensures not just legal compliance but can also aid in the smoother running of the winery, providing a clear record of production, sales, and taxation relevant to the business. By staying informed and diligent with these document requirements, winery owners and operators can focus more on the quality of their product and less on administrative hurdles.

Similar forms

The WV Frm 01 form, serving as a mandatory production report for licensed farm wineries in West Virginia, shares similarities with the Brewer's Report of Operations used by breweries. Both documents are essential for compliance with state regulations regarding the production of alcoholic beverages. They require detailed accounting of production volumes and are aimed at ensuring transparency and adherence to tax obligations. Like the WV Frm 01, the Brewer's Report necessitates accurate reporting of production figures, albeit for beer instead of wine, to assist in monitoring and tax collection efforts by state authorities.

Comparable to the WV Frm 01 is the Distilled Spirits Plant (DSP) Operations Report. This document is critical for distilled spirits producers, requiring them to detail their production, storage, and processing activities. Both forms serve a regulatory function, designed to track the production of controlled substances (wine in one case, distilled spirits in the other) and ensure compliance with federal and state laws. They help in the accurate calculation of taxes owed by the producer, facilitating a fair and efficient taxation system within the alcohol industry.

Another document similar to the WV Frm 01 form is the Monthly Wine Excise Tax Return that many wineries must file in various states. This return focuses on accounting for the amount of wine produced and sold, and the tax liability incurred as a result. Both this form and the WV Frm 05 aim to quantify the production aspects of winemaking for tax purposes. They are critical tools for state tax departments in collecting the appropriate amount of taxes from wineries, making sure that all produced wine is accounted for and taxed correctly.

The Tobacco Products Excise Tax Return is also parallel to the WV Frm 01 form, although it deals with a different product. This return documents the production, importation, or acquisition of tobacco products for taxation purposes. Similar to the WV Frm 01 form, which tracks wine production, the Tobacco Products Excise Tax Return enables state tax departments to monitor the tobacco industry. It ensures that excise taxes are properly calculated and collected, contributing to state revenue from regulated goods. While focused on different industries, both forms play crucial roles in maintaining tax compliance and supporting state fiscal health.

Dos and Don'ts

When filling out the WV FRM 01 form, there are several things you should and shouldn't do to ensure the process is smooth and the information provided is accurate. Follow these guidelines carefully to avoid common mistakes and to help streamline your submission.

- Do double-check all the information you enter in the form, ensuring it matches the details on ATF Form 702, Part 1, Line 2. Accuracy is key to a successful submission.

- Do make sure to sign the form. This is a requirement to validate the form. The signature affirms that to the best of your knowledge, the information provided is true and complete.

- Do report your total production gallons of wine produced by fermentation. This total is crucial for compliance with West Virginia Legislative Regulations.

- Don't use older forms of the WV FRM 01. The form has been redesigned, and using an outdated version may cause delays in the processing of your return.

- Don't forget to include your contact information, including a telephone number and e-mail address. This information is essential in case the Tax Department needs to reach you for any questions or clarifications regarding your submission.

- Don't overlook the submission deadline. The form must be filed within thirty (30) days after the end of the fiscal year or monthly, if you prefer. Adhering to this timeline is crucial to avoid potential issues or penalties.

By following these dos and don'ts, you'll help ensure that your WV FRM 01 form is accurately and promptly processed by the State Tax Department. For further assistance or more information, remember to visit the official website or contact their support directly.

Misconceptions

Discussing the WV FRM 01 form, several misconceptions can arise, leading to confusion. It's crucial to address these misunderstandings to ensure that those responsible for filling out the form have a clear grasp of its requirements and implications. Here are six common misconceptions and the truths that dispel them:

- The form is optional for licensed farm wineries in West Virginia.

This is incorrect. As mandated by the West Virginia Legislative Regulations, Title 175, Series 3-4.11, every licensed farm winery must report its total gallonage of wine produced or blended every year or partial year, making the submission of this form obligatory.

- It's acceptable to use older versions of the form for submission.

This statement is false. The notice clearly states that the form has been redesigned and explicitly instructs to avoid using older versions to prevent delays in processing. It is important to always use the latest version of the form to ensure compliance with current requirements.

- You only need to file the report if there was production activity.

This misconception can lead to non-compliance. The instructions specify that the report must be filed even if no activity occurred within the reporting period, emphasizing the need for all licensed farm wineries to submit the form regardless of their production levels.

- The report doesn't need to align with ATF Form 702, Part 1, Line 2.

Actually, the information reported on the WV FRM 01 must show the same quantities as those recorded on ATF Form 702, Part 1, Line 2. This requirement ensures consistency and accuracy in reporting across different regulatory bodies.

- Any method of submission is acceptable.

While it may seem convenient to submit through any channel, the form provides specific mailing instructions and also offers an online filing option through the stated website. Adhering to these instructions is crucial for the timely and proper processing of the form.

- Personal assistance is not available for filling out the form.

Contrary to this belief, the form lists both a phone number and an email address for contacting a person who can provide assistance concerning the return. This support can be invaluable for clarifying doubts and ensuring accurate completion and submission of the form.

Understanding these points clears up common misunderstandings about the WV FRM 01 form, aiding in accurate and timely compliance for licensed farm wineries.

Key takeaways

Filling out and using the WV FRM 01 form, designated for West Virginia Licensed Farm Wineries Production Reports, requires attention to detail and adherence to state guidelines. Below are key takeaways that can help ensure the process is smoothly navigated:

- Use the Current Form: The WV FRM 01 form has been updated. To avoid processing delays, it's important to use this version and not any older versions you might have. The State Tax Department's website offers the latest form.

- Report Even if No Activity: All licensed farm wineries in West Virginia must file this report annually, even if they did not produce or blend any wine during the reporting period. This fulfills a requirement under West Virginia Legislative Regulations. Failure to submit a report can result in penalties.

- Monthly Reporting Option: While the report covers the total gallons of wine produced or blended for the twelve-month period ending June 30 each year, wineries have the convenience of reporting this information monthly. This can help in keeping more accurate and manageable records.

- Accuracy is Crucial: The information provided on the WV FRM 01 form should align with the quantities reported on ATF Form 702, Part 1, Line 2. Accuracy is paramount to avoid discrepancies that could lead to audit or penalties.

- Signature Required: The form must be signed by the taxpayer, affirming under penalties of perjury that the information is true and complete. If someone other than the taxpayer prepares the form, their signature, address, and the date of preparation are also required. This ensures accountability and the veracity of the submitted information.

Finally, for further assistance or more information, licensees are encouraged to contact the West Virginia State Tax Department directly or visit their website. The option to file online also offers a more convenient submission path for many users.

Popular PDF Forms

Wvuc-a-154 - Provides information on unemployment benefits, taxes, and employer contributions in West Virginia.

West Virginia Court - Conduit for West Virginia businesses to support military veteran employment and receive corresponding tax benefits.

Wv 2848 - For businesses, providing the West Virginia Tax ID Number is essential for processing the form.