Fill Out a Valid Wv Cst 250 Form

In the realm of state compliance and taxation, the West Virginia CST-250 form serves a critical role for businesses engaging in transactions that necessitate the direct payment of consumers' sales and use tax to the West Virginia State Tax Department. This application enables entities—from manufacturers and service providers to charitable organizations and healthcare providers—to apply for a Direct Pay Permit, streamlining the process of tax remittance by allowing them to pay taxes directly to the state, bypassing the vendor collection route. A significant aspect of this application is its rigorous eligibility criteria, ensuring that only businesses with a valid Business Registration Certificate and a clean slate regarding state tax payments are considered. Moreover, it lays down a blueprint of responsibilities for permit holders, including notifying vendors of their direct pay status, maintaining rigorous records for inspection, and the timely filing of tax returns. Applicants must navigate through a detailed application process, subject to approval by the State Tax Department, which, upon granting the permit, imposes stringent compliance obligations. This mechanism not only facilitates a more direct and possibly efficient tax payment system but also embeds a framework for accountability and transparency in the interaction between businesses and the West Virginia tax infrastructure.

Sample - Wv Cst 250 Form

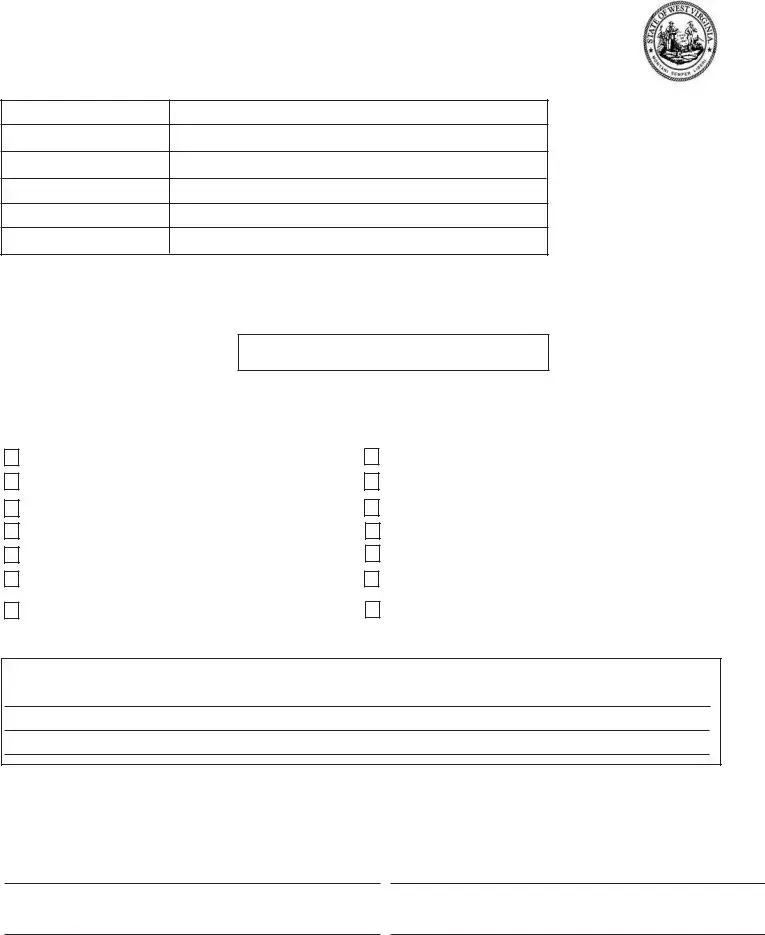

WEST VIRGINIA STATE TAX DEPARTMENT CONSUMERS SALES AND USE TAX APPLICATION FOR DIRECT PAY PERMIT

WESTVIRGINIAACCOUNT

IDENTIFICATIONNUMBER

LEGAL BUSINESS OR

CORPORATENAME

OWNER’SNAME (IF SOLE OWNER)

STREETADDRESS

CITY, STATE, & ZIP CODE

NAMEANDTELEPHONENUMBER

OF CONTACTPERSON

TO BE COMPLETED BY OWNER, PARTNER OR OFFICER OF CORPORATION

I, the undersigned, hereby certify that:

The above business has a valid

Business Registration Certificate #

The above business is not delinquent on the payment of any taxes imposed by Chapter 11 of the West Virginia Code; and This business satisfies one or more of the following conditions (check all applicable boxes):

Engaged in the business of manufacturing

Engaged in the business of producing natural resources

Engaged in the business of communication

Engaged in providing or operating a public utility service

A nationally chartered fraternal or social organization

Engaged in the business of generation, production or selling of electric power

A volunteer fire department organized and incorporated under the laws of West Virginia

Engaged in the business of gas storage

Engaged in the business of transportation

Engaged in the business of transmission

Engaged in the operation of a public utility business

Engaged in the business of research and development

A bona fide charitable organization that makes no charge whatsoever for service rendered

A health care provider purchasing drugs, durable medical goods, mobility enhancing equipment and prosthetic devices that are to be dispensed upon prescription

Give a detailed description of your business activity within West Virginia:

On behalf of the above business, I am hereby applying for a direct pay permit.

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and complete.

Signature of applicant |

Date |

Name of applicant (please print or type) |

Title (Owner, Partner, Officer of Corporation) |

Telephonenumber |

REV 5/08

The State Tax Commissioner may, in his discretion, authorize a person that is a user, consumer, distributor or lessee to which sales or leases of tangible personal property are made or services provided, to pay consumers sales and/or use tax directly to the West Virginia State Tax Department thereby waiving the collection of the tax by that person’s vendor. (W.Va. Code §

The issuance of a Direct Pay Permit imposes certain requirements on the holder of such permit. These requirements include:

1.Notification of each vendor from whom tangible personal property is purchased or leased or from whom services are purchased of his Direct Pay Permit Number and that any tax thereon will be paid directly to the Tax Commissioner. If the Direct Pay Permit Number is changed by the Tax Commissioner, all vendors must be renotified.

2.Filing a Direct Pay Consumers Sales or Use Tax Return on or before the 20th day of the month for the proceeding month’s or quarter’s transaction. Direct Pay Consumers Sales and Use Tax Returns not filed by the due date will be subject to interest and penalties and the permit may be cancelled.

3.Maintenance of books, records and invoices (including vendor lists) for inspection by the West Virginia State Tax Depart ment.

4.A Direct Pay Permit may not be used to purchase food, gasoline or special fuel.

INSTRUCTIONS FOR APPLICANT

This application is NOT valid unless all entries are completed.

Upon review of the application, the West Virginia State Tax Department will determine whether you are entitled to receive a Direct Pay Permit. Upon approval of your application, a numbered Direct Pay Permit will be mailed to you. Should your application be rejected, you will be notified in writing.

Direct Pay Consumers Sales and Use Tax Returns will be forwarded to you by the Department for remitting tax. If you do not receive a Direct Pay Consumers Sales and Use Tax Return within sixty (60) days after you receive your Direct Pay Permit, you must notify the West Virginia State Tax Department.

A Direct Pay Permit will continue to be valid until it is surrendered by you or cancelled. You will be notified by the State Tax Department of any change in your Direct Pay Permit number.

Upon surrender or cancellation of the Direct Pay Permit, the holder must promptly notify, in writing, the specified vendors from whom tangible personal property is purchased or leased or by whom services are rendered of such surrender or cancellation.

MAIL TO:

WEST VIRGINIASTATE TAX DEPARTMENT INTERNALAUDITINGDIVISION

PO BOX 425

CHARLESTON, WEST VIRGINIA

FOR ASSISTANCE CALL:

(304)

INTERNET ADDRESS

http://www.state.wv.us/taxdiv

Document Specifics

| Fact Name | Description |

|---|---|

| Form Reference | WV/CST-250 REV 5/08 |

| Purpose | Application for Direct Pay Permit for Consumers Sales and Use Tax |

| Applicable To | Businesses engaging in manufacturing, public utilities, certain non-profit organizations, and others specified in the form |

| Governing Law | West Virginia Code § 11-15-9d |

| Requirements for Permit Holders | Notification of vendors, maintenance of financial records, filing of returns, and restrictions on purchases with the permit |

| Prohibited Purchases | Food, gasoline, or special fuel |

| Validity and Cancellation | Direct Pay Permit remains valid until surrendered or cancelled, with requirements for notification upon change |

| Application Submission | Must be fully completed and mailed to West Virginia State Tax Department, Internal Auditing Division |

| Assistance and Contact Information | Contact numbers and internet address provided for support |

Guide to Using Wv Cst 250

Filling out the WV CST-250 form is essential for entities in West Virginia seeking a Direct Pay Permit, which allows them to remit consumer sales and use tax directly to the West Virginia State Tax Department, bypassing vendors. The process requires careful attention to detail to ensure all sections are completed accurately, thereby avoiding delays or issues with the application. This guide walks through each step needed to fill out the form properly.

- Start by providing the West Virginia Account Identification Number of your business in the designated space.

- Enter the Legal Business or Corporate Name as registered.

- If a sole owner, fill in the Owner’s Name.

- Provide the full Street Address, City, State, & Zip Code of the business location.

- Include the Name and Telephone Number of a contact person who can address any questions related to this application.

- Under the certification section, input the Business Registration Certificate # to affirm the company’s valid registration.

- Check the boxes that apply to the business’s activities from the options provided (e.g., manufacturing, health care provider, etc.), to indicate eligibility criteria.

- Provide a detailed description of your business’s activities within West Virginia in the space given.

- Sign the form to certify that the information provided is correct, complete, and under penalty of perjury. The signature of the applicant is required.

- Fill out the Date when the form is being signed.

- Print or type the Name of the applicant.

- Indicate the applicant’s Title (Owner, Partner, Officer of Corporation).

- Finally, write down the Telephone number where the applicant can be reached.

Upon completion, review the form to ensure that all entries are accurate and complete. Then, mail it to the West Virginia State Tax Department at the address provided on the form. If approved, a Direct Pay Permit will be mailed to you. Remember, holding this permit entails certain responsibilities like notifying vendors of the permit number, filing direct pay tax returns by due dates, maintaining records for inspection, and adhering to restrictions on purchases. It is important to understand these obligations to maintain the validity of the permit. Should you need assistance during the process or have not received a Direct Pay Consumers Sales and Use Tax Return within sixty days of permit issuance, contact the West Virginia State Tax Department directly.

Essential Points on Wv Cst 250

What is the purpose of WV/CST-250 form?

The WV/CST-250 form serves as an application for a Direct Pay Permit issued by the West Virginia State Tax Department. This permit allows certain businesses, such as manufacturers, utility service providers, and charitable organizations, to pay consumers sales and use tax directly to the state, instead of through the usual process where taxes are collected by vendors at the point of sale. The permit is designed to streamline tax processes for businesses that meet specific criteria set forth by the state.

Who is eligible to apply for a Direct Pay Permit?

Eligibility for a Direct Pay Permit is determined by the type of business and its activities within West Virginia. Applicants must have a valid Business Registration Certificate, must not be delinquent on any state tax payments, and must be engaged in certain types of business activities. These include manufacturing, natural resources production, communication, public utility services, electric power generation, gas storage, transportation, and several other specified sectors. Charitable organizations that offer services at no charge and health care providers purchasing certain medical supplies may also be eligible.

What are the requirements after obtaining a Direct Pay Permit?

Once a business obtains a Direct Pay Permit, it must follow specific requirements including notifying vendors of its permit number and the direct payment arrangement, filing sales and use tax returns on time, maintaining accurate records for state inspection, and adhering to restrictions on the purchase of items like food and gasoline with the permit. Failure to meet these requirements can result in penalties, including the possible cancellation of the permit.

How does a business apply for a Direct Pay Permit?

To apply for a Direct Pay Permit, a business must complete the WV/CST-250 form, providing detailed information about the business activities, and certifying that the application is true and correct under penalty of perjury. The application must be signed by an owner, partner, or corporate officer. Upon receipt, the West Virginia State Tax Department will review the application to determine eligibility for the permit.

What happens if the Direct Pay Permit application is rejected?

If the Direct Pay Permit application is rejected, the applicant will be notified in writing by the West Virginia State Tax Department. The notification will explain the reasons for rejection, giving the applicant the opportunity to address any issues or provide additional information that may be necessary for reconsideration.

How long is a Direct Pay Permit valid, and what are the renewal requirements?

A Direct Pay Permit remains valid until it is voluntarily surrendered by the business or cancelled by the Tax Department. There are no specific renewal requirements mentioned, but permit holders are required to notify the department and update their vendor list if their permit number changes or if the permit is surrendered or cancelled. It is also essential for businesses to stay compliant with all filing and record-keeping requirements to maintain their permit status.

Common mistakes

Filling out the WV/CST-250 form, an essential document for businesses in West Virginia seeking a direct pay permit for sales and use tax, requires careful attention to detail. However, certain common mistakes can lead to delays in processing or even the rejection of the application. Understanding these pitfalls can significantly streamline the application process and ensure compliance with state tax regulations.

- Not completing all entries: The application explicitly states that it is not valid unless all fields are filled. Skipping sections, whether intentionally or by oversight, is one of the most straightforward avoidable errors.

- Omission of the West Virginia business registration certificate number: This critical piece of information verifies the legitimacy of a business, and its absence can halt the entire process.

- Failure to clarify business activities within West Virginia: A detailed description of business activities in the state is required to assess eligibility for a direct pay permit, but applicants often provide vague or incomplete responses.

- Inaccurate representation of tax status: Applicants must certify that their business is not delinquent on any state tax payments. Misrepresentation, whether unintentional or not, can lead to severe repercussions, including legal penalties.

- Misunderstanding the scope of the permit: The form sets clear boundaries on what purchases the permit covers (excluding food, gasoline, or special fuel), which applicants sometimes overlook, leading to improper use of the permit.

- Ignoring the specific conditions for eligibility: The form outlines several business types and activities that qualify for the permit, such as manufacturing or operating a public utility. Applicants sometimes assume their eligibility without thoroughly verifying against these conditions.

- Forgetting to sign and date the form: This basic requirement is surprisingly commonly overlooked. An unsigned or undated form is invalid and results in processing delays.

- Providing incorrect contact information: The application requires accurate contact details to communicate the permit status and for future correspondence. Errors in this section can lead to miscommunication and potential non-receipt of critical documents like the Direct Pay Permit or the Sales and Use Tax Returns.

- Not notifying the Tax Department if Direct Pay Consumers Sales and Use Tax Returns are not received: It’s the applicant's responsibility to follow up if the necessary tax return forms are not received within 60 days after permit issuance. Neglecting this can lead to missed filing deadlines.

- Lack of preparation for permit responsibilities: Obtaining the permit obligates the holder to specific tasks, such as notifying vendors of the direct pay status and maintaining meticulous records for state inspection. Applicants may not fully comprehend these duties, leading to compliance issues down the line.

Avoiding these missteps requires a meticulous approach to filling out the WV/CST-250 form, from thoroughly reviewing eligibility criteria to double-checking every piece of information provided. Ensuring accuracy and completeness in the application not only facilitates a smoother review process by the West Virginia State Tax Department but also aligns with best practices for legal and financial compliance.

Documents used along the form

When businesses in West Virginia apply for a Direct Pay Permit using the WV/CST-250 form, it's part of a larger document ecosystem. The Direct Pay Permit allows them to pay sales and use tax directly to the state instead of through their vendors. This process necessitates additional forms and documents, ensuring compliance and reporting are up to standard. Let's explore some of the common forms and documents often used alongside the WV/CST-250 form.

- Business Registration Certificate: This certificate is proof that a business is officially registered to operate within the state. It's a prerequisite for applying for a Direct Pay Permit, as verified on the WV/CST-250 form.

- Monthly or Quarterly Consumers Sales and Use Tax Return: Permit holders are required to file regular tax returns, detailing their taxable transactions and remitting the appropriate tax directly to the West Virginia State Tax Department.

- Notification of Direct Pay Permit Number: A letter or form used to inform vendors of the business’s Direct Pay Permit. This communication is crucial as it notifies vendors that they should not charge sales tax at the point of sale.

- Vendor List: Maintaining a list of vendors is not only a requirement but a necessity for audit purposes. This document helps in tracking purchases and ensuring proper tax treatment.

- Record of Purchases: A detailed account of all purchases made under the Direct Pay Permit, which includes invoices and receipts. It's essential for preparing accurate tax returns and for audit purposes.

- Cancellation or Surrender Notification: If a Direct Pay Permit is either surrendered by the business or cancelled by the tax department, written notification must be sent to all affected vendors. This document is critical to ensure that vendors resume collecting sales tax on subsequent transactions.

Understanding and managing these documents are crucial for businesses holding a Direct Pay Permit to ensure compliance with West Virginia’s tax laws. Each plays a specific role in the process, from establishing the right to operate to fulfilling tax obligations. As intricate as this might seem, staying organized and attentive to documentation helps smooth the path for businesses navigating direct tax payment responsibilities.

Similar forms

The WV CST-250 form, serving as an application for a Direct Pay Permit for sales and use tax, closely aligns with the **Sales Tax Exemption Certificate** used in other states. Both documents facilitate a special status for entities allowing them to manage tax payments directly or be exempted under specific conditions. They're instrumental for businesses that meet certain criteria, offering them a streamlined way to handle tax obligations directly with state tax departments, bypassing the usual vendor collection process.

Another document strikingly similar to the WV CST-250 is the **Resale Certificate**. Retailers and resellers use this form to purchase goods tax-free that are intended for resale. The principle behind both documents is the presumption that taxes will be collected at the point of final sale, either directly from consumers or through the filing of special tax returns, thus preventing a "tax on tax" scenario.

The **Use Tax Direct Pay Permit Application** found in several states mirrors the intent behind the WV CST-2450. Both permit certain registered businesses to self-assess and remit taxes on taxable purchases directly to the tax authority, rather than paying sales tax to vendors. This facilitates a more direct and possibly more efficient process for tax reporting and payment for qualifying businesses.

Documents like the **Business Registration Certificate**, often required to operate legally in many states, share common ground with the WV CST-250. Just as the Business Registration Certificate proves a business's legitimacy and tax compliance, the WV CST-250 certifies a company’s eligibility for direct tax payments, ensuring compliance with state tax laws from another perspective.

The **Streamlined Sales Tax Agreement Certificate of Exemption** is another document that shares its purpose with the WV CST-250. Aimed at facilitating business operations across state lines with uniform sales and use tax collection, it similarly allows businesses to manage how tax is collected or paid, underlining the importance of compliance and streamlined operations in a multi-state context.

Similarly, the **Vendor’s License** issued for tax collection on sales in some states, folds into the same category. While it authorizes vendors to collect sales tax, the WV CST-250 permits the buyer to directly remit use tax, showing two sides of tax collection aiming to ensure tax is paid accurately and efficiently.

The **Commercial Fuels Tax License**, required for entities engaged in the sale, use, or distribution of fuel, aligns with the WV CST-250 in its goal to streamline the tax collection process. Both forms fulfill the specific need of regulated tax remittance directly to tax authorities, ensuring that commercial transactions comply with state tax statutes.

An **Employer Identification Number (EIN) Application** also shares similarities with the WV CST-250 form. While primarily used for federal tax identification, the process of obtaining an EIN is a fundamental step towards ensuring that businesses meet their tax obligations, much like the Direct Pay Permit facilitates state-level tax compliance for sales and use taxes.

The **Alcohol Beverage Control (ABC) License Application** serves a specialized purpose much like the WV CST-250, albeit in a different domain. Both require detailed business information and compliance with specific regulations to obtain a permit that affects how taxes or fees are collected or paid, underlining the regulatory oversight within specialized sectors of business.

Lastly, the **Environmental Regulatory Permit** applications, required for businesses that might impact natural resources, share a procedural kinship with the WV CST-250. Both types of applications necessitate a deep dive into the specifics of a business's operations and its impact - financially in the case of the WV CST-250, and environmentally for regulatory permits - showcasing the state's role in overseeing responsible business practices.

Dos and Don'ts

When applying for the WV CST-250, which is essentially the Consumers Sales and Use Tax Application for Direct Pay Permit in West Virginia, it's crucial to handle the form correctly to ensure its approval. Here are some guidelines to help you through the process:

What You Should Do:

- Ensure all entries are completed: The form clearly states it's not valid unless every entry is filled out. Don't leave anything blank.

- Provide a detailed business activity description: It's important to clearly outline your business activities within West Virginia. This clarifies your eligibility for the direct pay permit.

- Sign and date the application: This might seem obvious, but it's a crucial step. The form needs a signature and the current date to certify the information you've provided is accurate.

- Check applicable boxes: Be thorough in reviewing which conditions apply to your business. This helps the Tax Department understand your business operations better.

- Keep records accessible: Once you receive the Direct Pay Permit, maintain good records of all transactions. This includes keeping books, records, and invoices for inspection as required by the State Tax Department.

What You Shouldn't Do:

- Do not neglect to notify the Tax Department if you don't receive your return forms: If you haven't received your Direct Pay Consumers Sales and Use Tax Return within 60 days after receiving your permit, you must reach out to the department.

- Avoid using the permit for prohibited purchases: The permit cannot be used to buy food, gasoline, or special fuel. Make sure your purchases comply with the guidelines.

- Do not forget to renotify vendors if your permit number changes: It's your responsibility to inform each vendor of any changes to your Direct Pay Permit Number to ensure compliance.

- Avoid submitting incomplete applications: An incomplete application can lead to delays or rejection. Double-check to ensure every section is filled out correctly.

- Do not delay notifying vendors upon surrender or cancellation: Quick communication is essential if your permit is surrendered or cancelled for any reason. Make sure to inform your vendors promptly to avoid any misunderstandings.

Following these guidelines will streamline the application process for your WV CST-250 form, ensuring you can manage your sales and use tax directly with greater ease and compliance.

Misconceptions

There are several misconceptions about the West Virginia State Tax Department Consumers Sales and Use Tax Application for Direct Pay Permit (WV/CST-250). Understanding these misconceptions can help businesses navigate the complexities of obtaining and maintaining a direct pay permit in West Virginia.

Only large corporations can apply: It's a common belief that the WV/CST-250 form is exclusive to large corporations. However, a wide range of organizations, including volunteer fire departments, fraternal organizations, and even health care providers, can apply for a direct pay permit if they meet certain criteria.

The application is valid without complete entries: Every section of the WV/CST-250 application must be fully completed for it to be considered valid. Incomplete applications will not be processed, contradicting the assumption that some sections can be left blank if they seem inapplicable.

Direct Pay Permits cover all purchases: A misconception exists that holding a Direct Pay Permit allows a business to bypass sales tax on all purchases. In truth, the permit does not extend to items such as food, gasoline, or special fuel, which are exempt from direct payment provisions.

Permanent Permit: Some believe that once a Direct Pay Permit is issued, it remains valid indefinitely without need for renewal or review. This isn't the case; the permit can be surrendered or cancelled, and the holder must notify the State Tax Department and their vendors accordingly.

No need to notify vendors: Contrary to some opinions, businesses must inform each vendor of their Direct Pay Permit Number and the requirement to pay tax directly to the Tax Commissioner. This also applies if the permit number changes.

Late Returns Have No Consequences: Filing Direct Pay Consumers Sales or Use Tax Returns after the due date can lead to interest, penalties, and even permit cancellation, debunking the myth that late returns are a minor issue.

Application approval is guaranteed: Submitting an application does not ensure approval. The State Tax Department reviews each application to determine eligibility. If the criteria are not met, the application will be rejected.

Dispelling these misconceptions is crucial for businesses seeking to accurately comply with West Virginia's tax laws and regulations regarding the WV/CST-250 Direct Pay Permit. Proper understanding and management of these permits can significantly benefit an organization's operational compliance and fiscal health.

Key takeaways

Filling out and using the West Virginia CST-250 form, a Consumers Sales and Use Tax Application for Direct Pay Permit, entails important considerations that can affect a business's operations. Here are six key takeaways to understand:

- Determine eligibility: Not every business in West Virginia can apply for a direct pay permit. Eligibility is restricted to those involved in specific activities such as manufacturing, producing natural resources, communication, providing or operating a public utility service, among others listed on the form. Ensuring your business meets at least one of the qualification criteria is the first step.

- Complete application accurately: The application must be filled out completely, providing accurate information about the business, including contact details, a detailed description of business activities within the state, and a valid Business Registration Certificate number. Any oversight or misinformation can lead to delays or rejection of the application.

- Direct payment to Tax Commissioner: Approved businesses are authorized to pay consumers sales and/or use tax directly to the West Virginia State Tax Department, waiving the collection of tax by vendors. This means the business assumes the responsibility for accurately reporting and remitting taxes.

- Notice to vendors: Once a Direct Pay Permit is granted, the permit holder is required to notify each vendor from whom tangible personal property or services are purchased that the tax will be paid directly to the Tax Commissioner. Any change in the Direct Pay Permit number also necessitates renotification.

- Recordkeeping is essential: Businesses with a Direct Pay Permit must maintain accurate records, including books, invoices, and vendor lists, for inspection by the West Virginia State Tax Department. This documentation supports the direct payment of taxes and must be readily available.

- Limited purchasing scope: The Direct Pay Permit cannot be used for purchasing all items. Explicitly, food, gasoline, or special fuel are excluded from direct tax payment through this permit. Businesses must plan accordingly for these exclusions.

Fulfilling these requirements ensures that the privilege of a Direct Pay Permit is maintained without interruption, facilitating a more direct and potentially expedited tax payment process for eligible businesses.

Popular PDF Forms

West Virginia Auto Insurance Requirements - Dealing with a lost or stolen license plate becomes less daunting for vehicle owners with this simple yet vital document.

Wv Employee Withholding Form - Designed for West Virginia residents, this form helps with calculating and paying estimated individual income taxes.

West Virginia Police Report - Ensure clarity and compliance when filling out the West Virginia State Police report request form.