Fill Out a Valid Wv 8453 Form

The WV-8453 form serves as a pivotal document for individuals in West Virginia choosing to file their income tax returns electronically for the tax year 2005. This multi-functional form not only facilitates the electronic submission but also acts as a formal declaration by the taxpayer, confirming the accuracy and truthfulness of the submitted information. It comprehensively covers personal identification details, including names, Social Security numbers, and addresses, ensuring a direct link to the taxpayer's financial data. The form is detailed, requesting specifics on federal adjusted gross income and West Virginia income tax, among other financial figures, to accurately process refunds or deductions directly from bank accounts. Moreover, the form lays out a section for direct deposit or electronic funds withdrawal, a convenience that modern taxpayers appreciate, allowing for a seamless transaction process. Importantly, it carries a declaration from the taxpayer, endorsing the transmitted information's correctness under penalty of perjury, thereby underscoring the importance of accuracy in this process. Additionally, the WV-8453 mandates the involvement of an Electronic Return Originator (ERO), who must verify the information's completeness and correctness before submission, highlighting the checks and balances inherent in the electronic filing system. This critical aspect ensures an added layer of verification, enhancing the integrity of the electronic filing process. The form stipulates stringent requirements for retention, instructing EROs to keep the WV-8453 and all supporting documentation for a minimum of three years, a regulation that underscores the importance of record-keeping in tax administration.

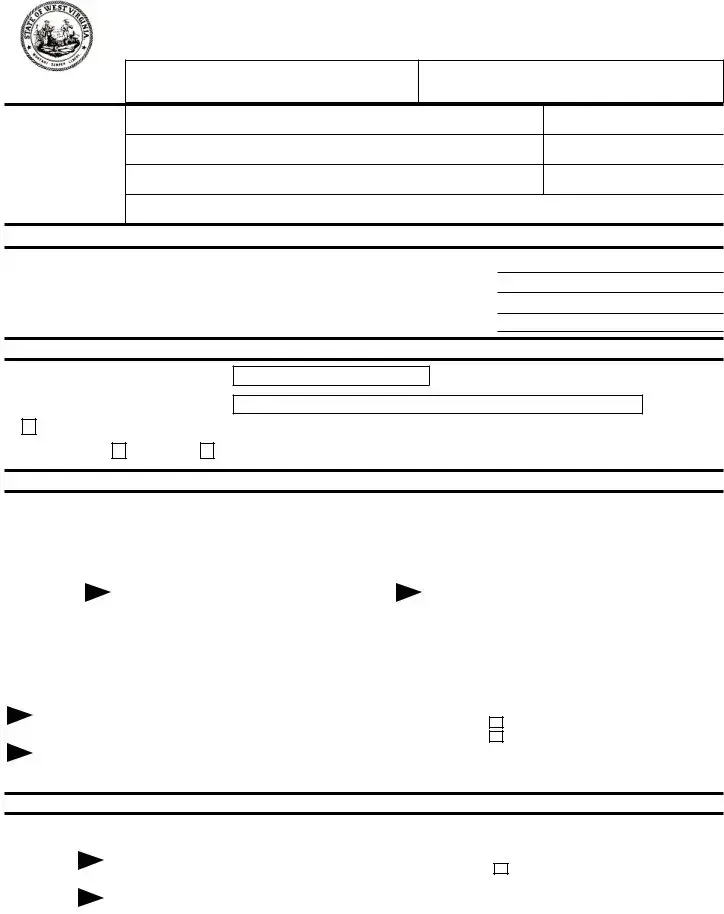

Sample - Wv 8453 Form

STATE OF WEST VIRGINIA

INDIVIDUAL INCOME TAX DECLARATION

FOR ELECTRONIC FILING

Rev. 09/2020

Period beginning (MM/DD/YYYY)

Period ending (MM/DD/YYYY)

Your first name and middle Initial |

Last Name |

Your Social Security Number

If a joint return, spouse’s first name and middle initial |

Last name, if different |

Spouse’s Social Security Number

Home Address (number and street)

Daytime telephone number

|

|

City, town or post office, state and ZIP code |

|

Part I |

|

Tax Return Information (whole dollars only) |

|

1. |

Federal Adjusted Gross Income |

1 |

|

2. |

West Virginia Income Tax |

2 |

|

3. |

Balance Due |

3 |

|

4. |

Refund |

4 |

|

Part II |

|

Direct Deposit or Electronic Funds Withdrawal |

|

5. |

Routing transit number (RTN) |

The first two numbers of the RTN must be 01 through 12 or 21 through 32 |

|

6. |

Depositor account number (DAN) |

|

|

7. |

Electronic Funds Withdrawal (Checking only; No Partial Payments) |

||

8. Type of account: |

Checking |

Savings (Direct Deposit Only) |

|

Part III |

|

Declaration of Taxpayer |

|

I consent that my refund be directly deposited or my payment due be withdrawn by electronic debit as designated in Part II. I further authorize the State of West Virginia to initiate debit entries and to initiate, if necessary, credit entries as adjustments for any entries in error into my Checking or Savings account as indicated above in Part II and the Financial Institution indicated above in Part II, to credit the same any amount(s) owed to me by the State of West Virginia. If I have filed a joint return, this is an irrevocable appointment of the other spouse as an agent to receive the refund or authorize the electronic debit.

Under penalties of perjury, I declare that I have compared the information contained on my return with the information I have provided to my Electronic Return Originator and that the amount described in Part I above agree with the amounts shown on the corresponding lines of my West Virginia income tax return. To the best of my knowledge and belief, my return is true, correct, and complete. I consent that my return, including this declaration and accompanying schedules and statements, be sent to the West Virginia State Tax Department, upon request by the Department. If I have filed a joint federal and state return, I understand that, if there is an error on either return, my state return will be rejected. If the processing of my return or refund

is delayed, I authorize the State Tax Department to disclose to my ERO and /or the transmitter the reason(s) for the delay, or |

|

when the refund was sent. |

|

|

||||||

Please |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Sign Here |

|

|

|

|

|

|

|

|

|

|

Your signature |

Date |

|

|

|

Spouse’s signature |

Date |

||||

|

|

|

|

|||||||

Part IV |

Declaration & Signature of Electronic Return Originator (ERO) & Paid Preparer |

|

|

|||||||

I declare that I have reviewed the above taxpayer’s return and that entries on Form

ERO’s Signature Firm Name

(or yours, if self- employed) and address

|

Date |

Check if: |

Your PTIN/SSN |

|

|

Paid Preparer |

|

|

|

|

|

|

|

Phone # |

El No. |

|

|

|

|

|

|

|

Zip Code |

|

|

|

|

ERO’s are instructed to retain the

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer is based on all information of which preparer has any knowledge.

Paid

Preparer’s

Use Only

Preparer’s

Signature

Firm Name (or yours, if

|

Date |

Check if: |

Your PTIN/SSN |

|

|

|

|

|

|

Phone # |

El No. |

|

|

|

|

|

|

|

Zip Code |

|

|

|

|

NOTE: Part IV of this form MUST be completed in full as required.

ERO’s are required to file and hold this document and all attachments for three (3) years from date filed.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The WV-8453 form is used as an Individual Income Tax Declaration for Electronic Filing in the State of West Virginia for the year 2005. |

| Governing Law | It is governed by the West Virginia State Tax Department regulations pertaining to the electronic filing of individual income tax returns. |

| Contents | Includes sections for taxpayer information, tax return information, a declaration for direct deposit or electronic funds withdrawal, and a declaration and signature section for the Electronic Return Originator (ERO) and paid preparer. |

| Electronic Filing Consent | Taxpayers consent to have their refund directly deposited or their payment due withdrawn by electronic debit as designated in the form. It also allows for adjustments in case of errors. |

| ERO and Paid Preparer's Role | EROs are responsible for reviewing the WV-8453 form for accuracy against the taxpayer's return, obtaining taxpayer signatures, providing copies to the taxpayer, and retaining the form and all supporting documents for at least three years. |

Guide to Using Wv 8453

Once you're ready to tackle the WV-8453 form, a clear pathway from start to finish ensures that your submission is both effective and compliant with the requirements. This process involves providing essential personal, tax, and banking information to facilitate electronic filing and any potential transactions with your tax return. Feel confident as you move forward, knowing that each step brings you closer to completing your tax obligations for the year.

- Start by entering your first name, initial, and last name in the designated fields. If filing a joint return, include your spouse’s first name, initial, and last name if it differs from yours.

- Proceed to fill in your Social Security Number (SSN). If filing jointly, also include your spouse’s SSN in the space provided.

- Write your home address, including the number and street. Do not forget to add any apartment or unit number.

- Next, enter your city, town, or post office, followed by your state and ZIP code in the respective fields.

- Provide a daytime telephone number where you can be reached for any inquiries related to your tax filing.

- In Part I, under Tax Return Information, enter your Federal Adjusted Gross Income from Form IT-140, Line 1, into the first box.

- Insert the amount of West Virginia Income Tax from Form IT-140, Line 8, into the second box.

- If there is a balance due, report this amount from IT-140, Line 17, in the third box.

- For any refund amount from Form IT-140, Line 22, document this in the fourth box.

- Moving to Part II, for Direct Deposit or Electronic Funds Withdrawal, supply your routing transit number (RTX), ensuring the first two numbers are within 01-12 or 21-32.

- Enter your depositor account number (DAN) as directed.

- If opting for Electronic Funds Withdrawal, specify it is for a checking account and clarify that no partial payments are allowed by checking the appropriate box.

- Indicate the type of account for Direct Deposit (either Checking or Savings) by marking the appropriate option.

- In Part III, the Declaration of Taxpayer, provide your consent for direct deposit or electronic withdrawal according to the details provided in Part II. Sign to declare that the information is accurate and complete to the best of your knowledge.

- Your spouse should sign the form as well if you're filing jointly.

- For Part IV, applicable to Electronic Return Originators (ERO) and Paid Preparers: Ensure that the ERO reviews the return information for accuracy. The ERO must sign and date the form, including their Preparer Tax Identification Number (PTIN)/Social Security Number (SSN), and if self-employed, their firm’s name, phone number, Employer Identification Number (EIN), and address.

After completing the form with due care, it’s important to check every field for accuracy. Ensuring the correct information is vital for a smooth processing experience. With everything in place, you've successfully navigated the required steps to fill out your WV-8453 form. This careful attention to detail supports a swift journey through the electronic filing process, leading to a timely acknowledgment from the West Virginia State Tax Department.

Essential Points on Wv 8453

What is the WV-8453 form used for?

The WV-8453 form is an individual income tax declaration designed for electronic filing within the State of West Virginia. It serves as a declaration by the taxpayer to consent to the electronic filing of their state income tax return for the specified tax year. This form also includes parts that allow for the direct deposit of refunds into a taxpayer's bank account or the electronic withdrawal of funds if there is a balance due. Additionally, it contains sections for taxpayer declarations and verification by the Electronic Return Originator (ERO) and Paid Preparer, if applicable.

Who needs to sign the WV-8453 form?

The WV-8453 form must be signed by the taxpayer filing the return. If the return is a joint return, it requires the signatures of both spouses. The form also includes a section for the declaration and signature of the Electronic Return Originator (ERO) and, if applicable, the Paid Preparer. These signatures certify that the information provided on the form and the corresponding entries on the taxpayer's income tax return are complete and correct to the best of their knowledge.

What information do I need to fill out in Part II for Direct Deposit or Electronic Funds Withdrawal?

In Part II of the form, you are required to provide the Routing Transit Number (RTN) and Depositor Account Number (DAN) for the bank account you wish to use for either direct deposit of your tax refund or electronic funds withdrawal for any balance due. You must also specify the type of account - either checking or savings - for direct deposits, and indicate that the electronic funds withdrawal is specifically for a checking account, as no partial payments are allowed through this method. Remember, the first two digits of the RTN must fall within the ranges of 01 through 12 or 21 through 32.

How long must EROs keep the WV-8453 form and supporting documents?

Electronic Return Originators (EROs) are instructed to retain the completed WV-8453 form along with all supporting documentation for a minimum of three (3) years from the date the return was filed. This retention requirement ensures that significant records are available for reference in case of inquiries from the State Tax Department or for verification of electronic filing particulars.

What happens if there is an error on my joint federal and state tax return?

If you have filed a joint federal and state tax return and there is an error on either return, the WV-8453 form outlines that your state return will be rejected due to the discrepancy. In such an event, you are authorized to disclose to the Electronic Return Originator (ERO) and/or the transmitter the reasons for the rejection, delay in processing the return or refund, or details regarding when the refund was dispatched.

Common mistakes

Filling out the WV-8453 form, which is the State of West Virginia Individual Income Tax Declaration for Electronic Filing, can be a straightforward process. However, it can lead to mistakes if not done with careful attention. Here are some common missteps that individuals often make:

- Incorrect Social Security Numbers (SSNs): One of the frequent mistakes is entering an incorrect Social Security number for oneself or a spouse if filing jointly. This error can lead to processing delays or incorrect tax assessments.

- Wrong Addresses: Another common error is listing an outdated or incorrect home address. This mistake can cause delays in receiving any correspondence or refunds from the tax department.

- Mathematical Mistakes: When filling out the tax return information, especially the federal adjusted gross income and West Virginia income tax amounts, mathematical errors can occur. These can affect the outcome of the tax return significantly.

- Inaccurate Bank Account Details: For the direct deposit or electronic funds withdrawal section, providing the wrong routing or depositor account number can mean refunds are sent to the wrong account or payments are not processed correctly, leading to penalties.

- Choosing the Wrong Account Type: When electing to receive a refund or make a payment via direct deposit or electronic funds withdrawal, failing to correctly specify the type of account (checking or savings) can cause transaction failures.

- Incomplete Declaration by Taxpayers: Sometimes, taxpayers might forget to complete the declaration part that requires their consent for direct deposit or electronic funds withdrawal, or they might not sign the form, making it invalid.

- Misunderstanding the Tax Preparer’s Role: Taxpayers sometimes fail to ensure that their electronic return originator (ERO) has signed Part IV of the form. The ERO's declaration is crucial for the processing of the electronic filing.

- Omitting Date and Signature: Another common overlook is not dating or signing the form. Both the taxpayer and their spouse, if filing jointly, need to sign and date the form to authenticate it.

- Forgetting to Attach Required Documentation: While the WV-8453 form is a declaration for electronic filing, there might be instances where additional documentation is needed. Failure to include such documentation can lead to processing delays.

Avoiding these mistakes can help ensure the smooth processing of your West Virginia State Income Tax Return. Furthermore, it's always advisable to double-check the information provided on the form, particularly the numbers and personal details, for accuracy before submission. Doing so can prevent unnecessary delays and ensure the accurate processing of your tax return.

Documents used along the form

When filing the WV-8453 form, a declaration for electronic filing of the West Virginia individual income tax, several other documents often accompany or are needed in the preparation process. This collection provides a comprehensive overview of taxpayer obligations and aids in accurate and efficient tax filing.

- Form IT-140: This is the West Virginia Personal Income Tax Return form. It details your income, deductions, and credits to calculate your state tax liability.

- W-2 Forms: These forms report an employee's annual wages and the amount of taxes withheld from their paycheck. They're essential for verifying income on your tax return.

- 1099 Forms: These documents report income from various sources other than wage, such as independent contractor work, interest, and dividends. Different types of 1099 forms cover different income sources.

- Schedule A (Itemized Deductions): If you choose to itemize deductions instead of taking the standard deduction, this form is necessary. It's used to calculate the total amount of your deductible expenses.

- Schedule C (Profit or Loss from Business): For those who are self-employed or have earned income from a business they operate, this form helps report profits or losses.

- Schedule E (Supplemental Income and Loss): This is used for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

- Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return): If you need more time to file your tax return, this form grants you an automatic six-month extension.

- Direct Deposit Information: While not a form, having your banking information ready is crucial if you choose to receive your refund via direct deposit. This includes the routing number and account number.

- Payment Voucher (Form WV/IT-140V): If you owe taxes and choose to mail your payment, this voucher accompanies your check or money order to ensure that your payment is correctly applied to your account.

Each document plays a crucial role in the filing process, contributing to an accurate and compliant tax return. Taxpayers should gather these documents early to ensure a smooth and efficient filing experience. Ensuring all relevant forms and documentation are complete and accurate can help avoid delays or issues with the West Virginia State Tax Department.

Similar forms

The WV-8453 form, serving as an electronic filing declaration for individual income tax in West Virginia, mirrors the functionality of the IRS Form 8879. IRS Form 8879 is the IRS e-file Signature Authorization, used for authorizing e-filing of a federal income tax return. Both documents function as official consents from the taxpayer, permitting the electronic submission of their tax returns to the respective tax authority. They also require signatures to verify the accuracy and truthfulness of the information provided, ensuring that the electronically filed tax returns are in agreement with the taxpayers' records and intentions.

Similarly, the Form 4868 shares a conceptual link with the WV-8453 form, albeit serving a different purpose. Form 4868 is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. While its primary role is to request additional time for filing a tax return rather than to submit tax data, it parallels the WV-8453's use of taxpayer information and signatures to authenticate a request or submission to the tax authorities. In both cases, the taxpayer's signature is essential for the document’s validity, reinforcing the authenticity of the taxpayers' requests and submissions.

The Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, is another document in the tax-filing realm with similarities to the WV-8453 form although it catogeners to business entities rather than individuals. Like the WV-8453, Form 7004 serves as a bridge between taxpayers and the tax authorities, facilitating a critical tax-related process via submission of requisite information and authentication through taxpayers’ or authorized representatives' signatures. Both forms underscore the taxpayer's consent and confirmation of the information being reported to tax agencies.

The UCC Financing Statement, while not a tax document, shares a common procedural essence with the WV-8453 form. This statement is a legal form that secures a lien on collateral in commercial transactions. Like the WV-8453, it involves the submission of information to a governmental body and includes declarations or authorizations verified by signatures. Though serving vastly different legal arenas—taxation for WV-8453 and secured transactions for the UCC Financing Statement—both require detailed information about the parties involved and rely on the integrity of the signatures to affirm the document’s veracity and compliance with respective laws.

Dos and Don'ts

When preparing to fill out the WV-8453 form for electronic filing of your West Virginia state income tax return, there are several key factors to bear in mind. This guidance is designed to help streamline the process and avoid common pitfalls.

What You Should Do- Double-check your Social Security Number (SSN) and any other identification numbers. Accuracy with numbers is crucial to ensure your return processes smoothly without delays.

- Ensure your name matches the one on your Social Security card. Discrepancies between your identification documents and your tax return can cause issues.

- Confirm the accuracy of your address. Any correspondence or refunds will be sent to the address listed, so it’s important to get it right.

- Review Part I for correct information transfer from your federal return. Errors in transferring information can lead to an incorrect state return.

- For direct deposits or withdrawals, confirm the routing and account numbers twice. Mistakes here could either delay your refund or cause payment issues.

- Sign and date the form where indicated. An unsigned form is like not filing at all and can lead to penalties.

- Keep a copy of the form and all related documents for your records. Should any questions arise, you’ll need these for reference.

- Check the declaration box in Part IV if you had assistance. This acknowledges the role of the preparer or Electronic Return Originator (ERO) in filling out the form.

- Ensure the preparer or ERO signs the form if applicable. This is a requirement for the form’s validity.

- Review the completed form for any errors or omissions. Submitting accurate information the first time can avoid processing delays.

- Avoid rounding off figures to avoid discrepancies. Make sure that you enter whole dollar amounts exactly as required.

- Don’t overlook the direct deposit or electronic funds withdrawal section. If choosing one of these options, this part of the form is critical.

- Resist the urge to leave any fields blank. If a section doesn’t apply, enter "N/A" or "0" as appropriate to show the question was not overlooked.

- Don’t forget to include your spouse’s information if filing jointly. Both parties' information is required for accurate processing of a joint return.

- Avoid using incorrect tax year forms. Make sure the form is for the correct year you’re filing; using an outdated form can lead to errors.

- Don’t guess on any of the entries. If you’re unsure, it’s better to seek clarification or assistance than to make a mistake.

- Avoid waiting until the last minute to fill out the form. Rushing can lead to errors or missed deadlines.

- Do not attempt to alter the form after it’s been submitted. If you find an error after submitting, follow the appropriate procedures for amending a return..

- Don’t ignore instructions or guidelines provided with the form. These are there to help you fill out the form correctly and completely.

- Do not discard documents that support your electronic submission. These may be needed to verify the information on your form and should be kept for at least three years.

Misconceptions

When dealing with tax forms such as the WV-8453, a myriad of misconceptions can arise, largely due to its specific terminology and the complexity of tax laws. Clearing up these misunderstandings is key to navigating the filing process smoothly. Here are ten common misconceptions about the WV-8453 form:

It's only for electronic filers: While the WV-8453 form is an electronic filing declaration, it's a critical part of the process for those who opt for a professional to electronically file their West Virginia individual income tax returns. It's not solely for individuals directly filing online on their own.

No signature needed: Signatures are crucial. Both the taxpayer and, if filing jointly, the spouse must sign the form, authorizing the processing of their tax return information electronically.

Direct deposit is automatic: For a refund to be directly deposited, taxpayers must provide their banking information in Part II of the form. It's not an automatic process just because you're filing electronically.

Preparer's signature isn't important: On the contrary, if a paid preparer is involved, their signature is required in Part IV, alongside the declaration that they've reviewed the return and believe it to be correct.

All types of bank accounts are accepted for refunds: The form specifies that direct deposits can only be made into checking or savings accounts. Other types of accounts, like investment accounts, are not permissible for direct deposit of refunds.

Partial payments are allowed with electronic withdrawal: The form clearly states that if you opt for electronic funds withdrawal for a balance due, partial payments are not accepted. The amount owed must be paid in full.

Filing jointly requires both parties to separately submit a WV-8453: In fact, a joint return only necessitates one WV-8453 form, signed by both parties.

Filing this form speeds up the refund process: While electronic filing can be quicker than paper filing, submitting Form WV-8453 itself does not guarantee a faster refund. The processing speed also depends on the overall accuracy of the return and the current workload of the tax department.

This form authorizes the tax preparer to receive the refund on behalf of the taxpayer: The form does authorize electronic transactions related to the refund or payment but does not permit the preparer to receive the refund. Refunds are directed to the taxpayer's account or issued as a check.

Error corrections are not possible after submission: If there are errors in the electronic submission, corrections can indeed be made. However, this might delay processing. The form permits the state tax department to communicate with the electronic return originator (ERO) for reasons related to delays, including necessary corrections.

Understanding these aspects of the WV-8453 form can demystify the process, making tax filing a more straightforward task. It's always advisable to read through the instructions and consult a professional if uncertainties remain.

Key takeaways

The WV-8453 form is an important document for residents of West Virginia who choose to file their individual income tax returns electronically. Understanding the proper way to complete and utilize this form is essential for ensuring the process is carried out effectively and efficiently. Here are some key takeaways regarding the WV-8453 form:

- Filing Status and Identification: When filling out the WV-8453 form, it is crucial for taxpayers to accurately provide their first name, initial, and last name, along with the Social Security Numbers (SSNs) for both themselves and their spouse if filing jointly. This information is foundational as it identifies the taxpayer and ensures that their electronic filing accurately reflects their tax obligations and entitlements.

- Tax Return Information: The form requires specific financial details from the taxpayer, including their Federal Adjusted Gross Income and the amount of West Virginia Income Tax owed or refund due. These figures should match those reported on Form IT-140, thereby ensuring that the electronic filing is consistent with the taxpayer’s overall tax records.

- Direct Deposit or Electronic Funds Withdrawal: Taxpayers have the option to receive their refunds via direct deposit into a checking or savings account, or to authorize an electronic funds withdrawal for any amounts due. Accurate routing and account numbers are essential to ensure the correct transfer of funds. This feature of the WV-8453 form simplifies the refund process and makes paying taxes more convenient.

- Declaration of Taxpayer: By signing the WV-8453 form, the taxpayer consents to the electronic filing of their return and, where applicable, the direct deposit of refunds or withdrawal of funds due. For joint returns, the signature also serves as an irrevocable appointment of the spouse as an agent to receive the refund or authorize payment. It’s a significant step that binds the taxpayer to the declarations made in the document under penalties of perjury, asserting that the information provided is accurate and complete to the best of their knowledge.

- Retention by Electronic Return Originator (ERO): The WV-8453, alongside all supporting documents, must be retained by the ERO for a minimum of three years. This is a critical requirement that ensures records are available for review if questions arise about the electronic submission in the future. The ERO is an authorized agent that plays a pivotal role in the process, ensuring the accuracy and completeness of the electronic filing.

This overview provides guidance for navigating the process of electronic tax return filing in West Virginia, highlighting the importance of accuracy, consent, and record retention as part of this process. By following these guidelines, taxpayers can help ensure their tax filing experience is smooth and successful.

Popular PDF Forms

Wv Peia Prior Authorization - Includes necessary contact information for submission including fax and phone numbers.

Wv State Inspection Near Me - Key details on the requisition protocol, including a mandatory signature of the authorized person.