Fill Out a Valid West Virginia Estimated Tax Form

In the picturesque state of West Virginia, residents who anticipate owing at least $600 in state tax are required to navigate the complexities of the West Virginia Estimated Tax Form, officially known as WV/IT-140ES. Managed by the State Tax Department's Tax Account Administration Division, this crucial document presents a systematic approach to prepaying taxes, a task that unfolds annually for many. Bearing the responsibility to accurately calculate and submit the correct amount necessitates a keen understanding of the instruction brochure Form IT-140ESI, available on the state's tax website. The form is designed to ensure individuals can meet their tax obligations in a timely manner, with specific due dates outlined for those whose financial years do not align with the calendar year. Additionally, it accommodates changes in personal information, requiring updates to be meticulously documented to avoid discrepancies. The process, while seemingly straightforward, underscores the importance of diligent tax planning, enabling taxpayers to avoid the penalties associated with underpayment. With the convenience of online filing and the support provided via telephone, the State of West Virginia endeavors to streamline this annual ritual, making compliance accessible for all its residents.

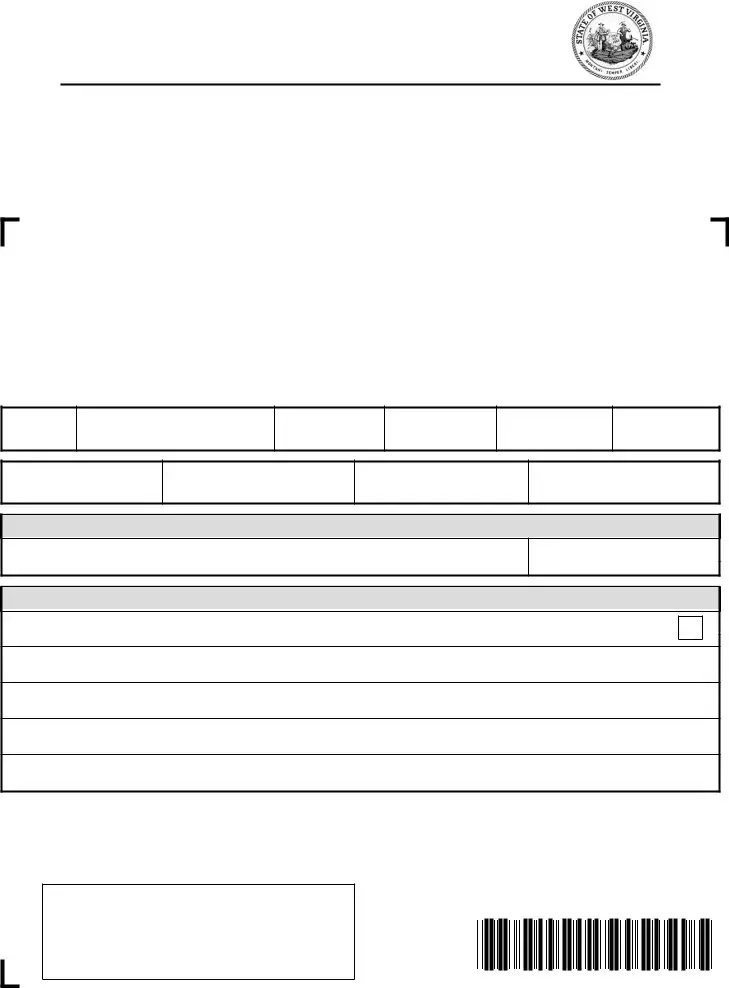

Sample - West Virginia Estimated Tax Form

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 342

Charleston, WV

_____________________________________________________________ |

Letter Id: |

L0045367296 |

||

DONNA J. AAROE |

|

|

||

Name |

|

|

|

|

17 CLUB HOUSE DR |

|

|

Issued: |

02/01/2019 |

_____________________________________________________________ |

||||

EVANS WV |

|

|

Account #: |

|

Address |

|

|

|

|

_____________________________________________________________ |

Period: |

12/31/2018 |

||

City |

State |

Zip |

||

INDIVIDUAL ESTIMATED INCOME TAX PAYMENT

Account #:

Taxable Year End:

Payment Due Date:

Your Social Security Number:

Spouse's Social Security Number:

Part 1: Payment

Amount of This Payment

Part 2: Change of Address

Check here and complete the CHANGE OF ADDRESS if any information preprinted on this form is incorrect or changed:

Name(s):

Mailing Address:

City:

State and Zip Code:

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 342 , Charleston, WV

FOR ASSISTANCE CALL (304)

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

P 0 9 0 9 1 8 0 1 W

INSTRUCTIONS FOR MAKING ESTIMATED PAYMENTS

If you expect to owe at least $600 in State tax when you file your annual income tax return, you are required to make estimated tax payments using this form.

Determine your estimated tax using the instruction brochure (Form

Write the amount of your payment on this form. You must pay at least the minimum amount calculated using the instructions to avoid being penalized; however, you may pay more than the minimum if you wish.

Be sure to post your payment in the payment table. If you are not a calendar year taxpayer, you should see the instructions to determine the due dates of your payments.

Estimated tax payments should be mailed by the due date to:

State Tax Department

Tax Account Administration Division - EST P.O. Box 342

Charleston WV

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of WV/IT-140ES Form | This form is used for making individual estimated income tax payments in the state of West Virginia. |

| Requirement for Filing | If an individual expects to owe at least $600 in state tax when filing their annual income tax return, they are required to make estimated tax payments using this form. |

| Due Date for Payments | Estimated tax payments must be mailed by the due date specified in the instructions, which varies for calendar year and non-calendar year taxpayers. |

| Governing Law | West Virginia state tax laws govern the requirements and procedures for estimated tax payments, as facilitated by the State Tax Department, Tax Account Administration Division. |

Guide to Using West Virginia Estimated Tax

When it comes to fulfilling tax responsibilities in West Virginia, making estimated tax payments is a critical process for many taxpayers. Estimated tax payments allow taxpayers to pay taxes on income not subject to withholding. Cases requiring such payments include earnings from self-employment, interest, dividends, rents, and alimony. Properly filling out the West Virginia Estimated Tax form, identified as WV/IT-140ES, ensures that these payments are credited correctly to your tax account, avoiding potential penalties for underpayment of taxes due. The following steps will guide you through completing this form:

- Start by reviewing the pre-printed information on the form to verify its accuracy, including your name (Donna J. Aaroe), address (17 CLUB HOUSE DR, EVANS WV 25241-9402), the period ending (12/31/2018), and your account number (2094-9145). If any information has changed, check the box in Part 2 for a Change of Address.

- Enter your social security number and, if applicable, your spouse's social security number in the designated spaces.

- In Part 1, under "Payment Amount of This Payment," write the amount of your estimated payment. This amount should be determined based on your expected tax liability for the year, following the guidance provided in the instruction brochure Form IT-140ESI found on the West Virginia State Tax Department's website.

- If your address has changed, or the preprinted information is otherwise incorrect, complete the "Change of Address" section in Part 2. Fill in the correct name(s), mailing address, city, state, and zip code.

- Review the entire form to ensure all the information provided is correct and complete.

- Prepare a check or money order for the amount of your payment, making it payable to "West Virginia State Tax Department." Include "WV/IT-140ES," your social security number, and the taxable year on your payment to ensure it is correctly applied.

- Mail the completed WV/IT-140ES form along with your payment to the following address: State Tax Department Tax Account Administration Division - EST, P.O. Box 342, Charleston, WV 25322-0342. Ensure that your form and payment are mailed by the due date to avoid any late penalties.

By following these steps carefully, you will have successfully completed the West Virginia Estimated Tax Form. It's important to keep a copy of this documentation for your records and to note the due dates for any future payments. Timely and accurate payments help manage your tax obligations effectively, preventing potential issues with underpayment and ensuring peace of mind throughout the tax year.

Essential Points on West Virginia Estimated Tax

What is the West Virginia Estimated Tax form?

The West Virginia Estimated Tax form, identified as WV/IT-140ES, is a document designed for taxpayers who expect to owe at least $600 in State tax on their annual income tax return. It is used to make quarterly estimated payments toward the taxpayer's state tax obligation.

Who needs to fill out the West Virginia Estimated Tax form?

Any individual who anticipates owing at least $600 in state taxes for the year is required to fill out and submit the West Virginia Estimated Tax form. This typically includes individuals who do not have taxes withheld from their salary or those who anticipate significant income from other sources.

How can one determine how much to pay for each estimated tax payment?

Using the instruction brochure Form IT-140ESI, available at the official website www.tax.wv.gov, individuals can calculate their estimated taxes. Payments should not be less than the minimum amount calculated via the instructions. However, taxpayers have the option to pay more than the minimum to avoid underpayment penalties.

What happens if information preprinted on the form is incorrect or has changed?

If any preprinted information is incorrect or has changed, individuals should check the "Change of Address" box on their form. They are then required to provide the correct name(s) and mailing address, including city, state, and zip code, to ensure their records are up to date.

Where should the West Virginia Estimated Tax payments be mailed?

Payments should be mailed to the State Tax Department, Tax Account Administration Division - EST, P.O. Box 342, Charleston, WV 25322-0342. It's important to send the payments by the due date to avoid any potential penalties.

Can payments be filed online?

Yes, individuals have the option to file their estimated tax payments online by visiting https://mytaxes.wvtax.gov. This platform offers a convenient way to manage and submit estimated tax payments securely.

Who can be contacted for assistance regarding the West Virginia Estimated Tax form?

For assistance, individuals can call the West Virginia State Tax Department at (304) 558-3333 or toll-free at (800) 982-8297. Additionally, more information and resources can be found on their website at www.tax.wv.gov.

Common mistakes

Filling out the West Virginia Estimated Tax form is a crucial process, yet it is one where many find themselves making mistakes. Understanding these common errors can help ensure accuracy and compliance with the state's tax laws. Here are five typical mistakes to avoid:

- Overlooking Personal Information Updates: It's easy to overlook changes in personal information. If there has been a change in your name, address, or Social Security number since last filing, it's essential to check the 'Change of Address' box and update the information on the form. Failing to do so can lead to misplaced documents and miscommunication with the Tax Department.

- Miscalculating Estimated Payments: Many people either underestimate or miscalculate their estimated tax payments. Using the instructions provided in the Instruction Brochure (Form IT-140ESI) available at the West Virginia Tax Department's website will help accurately determine your estimated taxes and avoid underpayment penalties.

- Missing Payment Due Dates: Each installment has a specific due date. Not marking these dates on your calendar and failing to send payments on time can lead to unnecessary penalties and interest charges. It’s vital to mail your payments by the due dates to avoid extra costs.

- Incorrect Use of Payment Table: Not properly posting your payment in the payment table is a common mistake. This step is crucial for the Tax Department to accurately track your estimated tax payments throughout the year. Ensure each payment is correctly entered to maintain accurate records.

- Neglecting to Keep Copies of Documents: Many filers forget to keep a copy of their completed estimated tax form and any accompanying documents. Maintaining copies is important for your records and facilitates a smoother process in case any discrepancies or questions arise regarding your payments.

By avoiding these common errors, you can streamline the process of completing the West Virginia Estimated Tax form. Maintaining diligence in updating personal information, calculating your estimated payments accurately, adhering to payment schedules, correctly using the payment table, and keeping thorough records are all practices that will contribute to a smoother tax filing experience. Remember, when in doubt or if you encounter any challenges, assistance is available through the State Tax Department by phone or on the website. Establishing an early habit of meticulousness and attentiveness when handling your estimated tax forms can save time, money, and stress in the long run.

Documents used along the form

When managing taxes, especially estimated taxes as in West Virginia, individuals frequently encounter a variety of forms and documents that help streamline the process. Whether you're a seasoned taxpayer or new to the realm of estimated taxes, understanding these additional documents is crucial to ensure compliance and optimize your tax management strategy. Each document serves a specific role, from helping calculate your estimated taxes to making changes to your account.

- Form IT-140ESI: This is the instruction brochure for completing the WV/IT-140ES West Virginia Estimated Tax form. It offers detailed guidance on how to calculate your estimated tax payments, ensuring you pay the correct amount and avoid potential penalties.

- Form IT-140: The West Virginia Personal Income Tax Return form is essential for reporting your yearly income. It's used to reconcile the estimated payments made throughout the year with your actual tax liability.

- Form WV/IT-104: This form serves as the West Virginia Employee's Withholding Exemption Certificate, allowing individuals to specify exemptions and adjust withholding from their paychecks, potentially affecting their need for estimated tax payments.

- Form IT-141: West Virginia Fiduciary Income Tax Return, which applies to estates and trusts, indicating that not only individuals but also entities may have obligations related to estimated taxes.

- Form WV/IT-104R: This form is designed for residents to amend their tax returns. It might be necessary if an error was discovered after submitting their original tax return, impacting their estimated tax calculations or payments.

- Change of Address Form: While not a tax form per se, a Change of Address form is critical for ensuring that all correspondence and necessary tax documents from the West Virginia State Tax Department reach the taxpayer. This is vital for receiving updates about estimated tax payments or any required action.

Grasping the function and importance of each document associated with the West Virginia Estimated Tax form can significantly demystify the process of managing your taxes. Properly utilized, these forms can provide a comprehensive framework for ensuring your tax responsibilities are met efficiently and accurately. With these tools at your disposal, navigating the complexities of the tax system can be a far less daunting task.

Similar forms

The Internal Revenue Service (IRS) 1040-ES form, utilized for estimating federal tax payments, shares a significant resemblance to the West Virginia Estimated Tax form. Both serve the purpose of allowing individuals to calculate and pay their estimated taxes quarterly. These documents are designed to help taxpayers avoid underpayment penalties by forecasting their income tax liability for the year and making payments towards that liability on a quarterly basis. The structure and purpose align closely, as they guide taxpayers in both federal and state spheres to preemptively manage their tax obligations.

Voucher payment forms, which are often found in the realm of property taxes, also bear a similarity to the West Virginia Estimated Tax form. These vouchers enable property owners to remit their anticipated property tax payments. Much like the estimated tax forms, these vouchers are typically used in scenarios where taxpayers seek to distribute their payment obligations over the year, thus lessening the financial burden of a single, lump-sum payment. The core concept lies in the structured anticipation and fulfillment of payment obligations ahead of the official billing period.

The State of California Estimated Tax for Individuals form closely aligns with the West Virginia Estimated Tax form in both structure and intent. Both forms are tailored to the individual taxpayer, offering a directive for calculating and submitting estimated income tax payments throughout the fiscal year. These forms address the state-level taxation requirements, ensuring taxpayers make adequate payments on a quarterly basis to meet their tax obligations and avoid potential penalties for underpayment.

Business estimated tax forms, such as the Federal 1040-ES for business owners or the equivalent state forms, share commonalities with the West Virginia Estimated Tax form tailored for individual taxpayers. While the target audience may differ—focusing on businesses rather than individuals—the foundational purpose remains consistent: to facilitate the advanced calculation and payment of taxes based on estimated earnings. These forms provide a systematic approach for entities to comply with their tax responsibilities incrementally, mitigating the impact of a singular, annual payment.

State of Ohio IT 1040ES, another state's approach to estimated tax payments, parallels the West Virginia form in facilitating taxpayers' proactive management of their tax dues. These forms exemplify the states' efforts to standardize the process of estimated tax payments for their residents. The similarity underscores a broader systemic approach among various states to aid taxpayers in handling their estimated taxes, offering a structured method to assess, calculate, and remit taxes due in a timely manner.

Amended tax return forms, while serving a slightly different function, echo the preemptive tax management intent of the West Virginia Estimated Tax form. Amended forms allow taxpayers to correct previously submitted tax returns to either increase or decrease their tax liability. This process, although retrospective, shares the forward-looking goal of ensuring taxpayers' obligations accurately reflect their financial circumstances. Both kinds of documents emphasize accurate financial reporting and tax compliance, albeit from different temporal perspectives.

Address change forms provided by tax authorities for notifying changes in a taxpayer's mailing address or personal details have a functional similarity to the portion of the West West Virginia Estimated Tax form that allows for address updates. Although primarily administrative, this section acknowledges the dynamic nature of taxpayers' lives and ensures that communications and tax documents reach them correctly. It demonstrates the integration of logistical and procedural elements within tax management practices, facilitating seamless communication between taxpayers and tax authorities.

Dos and Don'ts

When filling out the West Virginia Estimated Tax form, there are key practices you should follow to ensure the process is smooth and error-free. Here is a helpful guide:

- Do review the instruction brochure (Form IT-140ESI) available at the official website to accurately determine your estimated taxes. This step is crucial to avoid underpayment or overpayment.

- Do write your payment amount clearly on the form. This helps in ensuring that your payment is processed correctly and can help avoid potential confusion.

- Do make sure to pay at least the minimum amount calculated using the official instructions. This is important to avoid any penalties that might arise from paying less than what is due.

- Do check the Change of Address box and update your information if anything preprinted on the form is incorrect or has changed. Keeping your address current is vital for receiving timely updates and correspondence.

Equally important are the practices you should avoid:

- Don't overlook the importance of checking whether you are a calendar year taxpayer or not. This affects your payment due dates, and missing this step could lead to missed or late payments.

- Don't ignore the need to review your Social Security Number and your spouse's (if applicable) on the form. Accurately entering these numbers is crucial for your tax records.

- Don't delay mailing your estimated tax payments. Ensure they are sent by the due date to the State Tax Department to avoid potential late fees or penalties.

- Don't forget to utilize the online resources and assistance provided by the West Virginia State Tax Department. Whether it's to clarify doubts or seek guidance, the direct help lines and official website are valuable tools.

By following these do's and don'ts, you're on the right path to successfully managing your estimated tax payments in West Virginia. Remember, being thorough and attentive to details can ease your tax responsibilities and prevent unnecessary complications.

Misconceptions

One common misconception is that the West Virginia Estimated Tax Form (WV/IT-140ES) is only for individuals who derive income from within the state. In fact, residents who earn income from both within and outside of West Virginia are obligated to account for all of their income on this form, regardless of the source. This comprehensive requirement ensures equitable taxation of all income, adhering to principles of fairness in the state's tax system.

Another misunderstanding concerns the belief that estimated tax payments are optional for those who anticipate owing less than $600 in state taxes. While the instructions specify a threshold of $600 to mandate estimated payments, this guideline does not exempt individuals from their total tax liability at the end of the tax year. It merely outlines the conditions under which estimated payments are compulsory to prevent underpayment penalties. Taxpayers should therefore assess their income critically to avoid unexpected liabilities.

Many also erroneously believe that making an estimated tax payment automatically updates their address with the West Virginia State Tax Department. However, the form makes it clear that a change of address must be explicitly indicated by checking the appropriate box and providing updated information. Simply making a payment without this notification does not fulfill the responsibility to keep personal information current with the tax authorities.

There's a misunderstanding about the role of the online filing system. Some taxpayers think that if they file their estimated taxes online, they do not need to mail the paper form. While the State Tax Department encourages online filing for efficiency and environmental reasons, completing the process online only fulfills the requirement if the taxpayer receives a confirmation. Without this confirmation, the responsibility to ensure the payment has been received and processed by the tax department remains with the taxpayer.

Lastly, a significant misconception surrounds the penalty for underpayment of estimated taxes. While the form and accompanying instructions discuss minimum payment amounts to avoid penalization, some taxpayers assume these guidelines provide leniency for late payments. In reality, the state assesses penalties based on the amount unpaid and the period of delinquency. Thus, timeliness, as well as accuracy in payment, are crucial to avoiding financial penalties.

Key takeaways

- If you expect to owe at least $600 in State tax, making estimated tax payments via the West Virginia Estimated Tax form is required. This helps avoid penalties for underpayment at the year's end.

- Use the instructional brochure (Form IT-140ESI) available on the West Virginia State Tax Department's website to accurately calculate your estimated tax. Doing so ensures you're paying the correct amount throughout the year.

- Payments need to be posted in the payment table of the form. You have the flexibility to pay more than the minimum required amount if you prefer, which can help reduce the amount owed when filing your annual tax return.

- For due date and mailing address, make sure to send your payments to the State Tax Department Tax Account Administration Division - EST P.O. Box 342, Charleston, WV 25322-0342 by the specified deadline. If your payment schedule doesn't align with the calendar year, refer to the instructions to determine your specific payment due dates.

Popular PDF Forms

Wv Court Forms - Links to the state's tax website for further guidance, ensuring taxpayer accessibility to additional resources and assistance.

Wv State Social Studies Fair - Migration Patterns in West Virginia: Examining census data and conducting interviews to understand the reasons behind population shifts.

Wv S - The WV/NRW-4 allows nonresidents to efficiently manage their tax obligations in West Virginia, avoiding unnecessary withholdings.