Fill Out a Valid Tax POA wv-2848 Form

Navigating the complexities of tax-related matters often necessitates the provision of authorized access and decision-making power regarding one's financial affairs to a designated individual or entity. This is where the Tax Power of Attorney (POA) WV-2848 form becomes an essential tool for residents of West Virginia. It serves as a written authorization allowing a trusted person or professional, typically an accountant or attorney, to handle tax matters on another's behalf. The form outlines the specific types of tax matters and years or periods for which authority is granted, ensuring that the scope of power is clearly defined. Employing the WV-2848 form not only simplifies the process of managing tax responsibilities but also provides peace of mind, knowing that tax affairs are being handled competently and with authority. With its pivotal role in financial management and tax administration, understanding how to properly complete and utilize the WV-2848 form is crucial for both individuals and tax professionals in West Virginia.

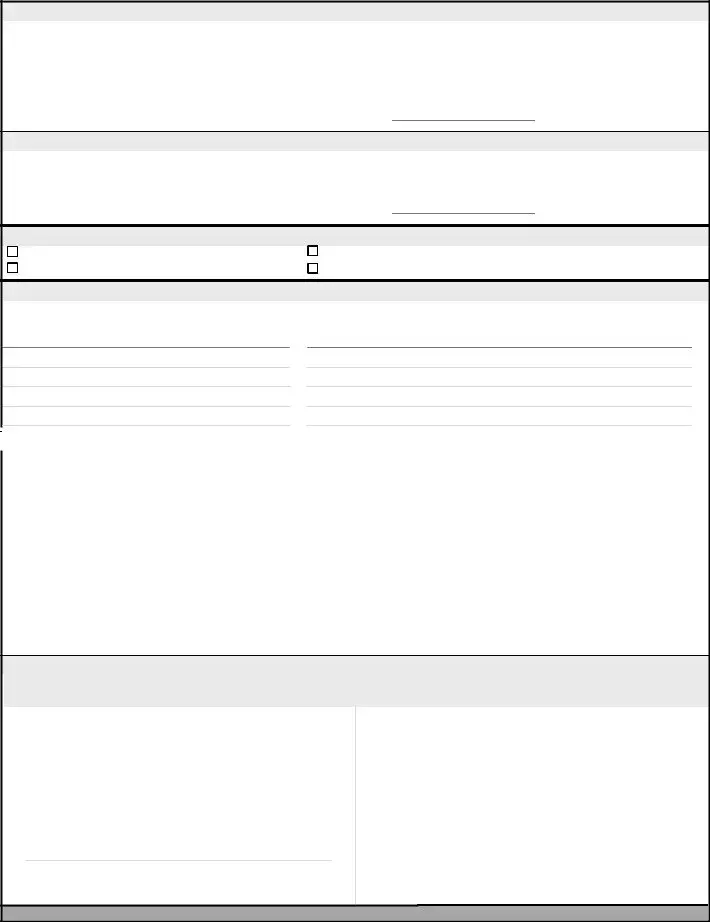

Sample - Tax POA wv-2848 Form

Rev. 12/15

West Virginia State Tax Department

Authorization of Power of Attorney

Authorization giving the person you name on this form specified powers to act on your behalf in interacting or communicating with the West Virginia State Tax Department

Type or print the information you provide on this form. Incomplete, faxed, or photocopied forms will be REJECTED.

1| PRINCIPAL INFORMATION The business or individual granting the power of attorney

Print Name of Individual or Business |

SSN, |

FEIN, |

or |

Tax ID # |

|

Phone # |

|

|

|

|

|

|

|

Print Name of Spouse or Corporate Officer and Title |

SSN, |

FEIN, |

or |

Tax ID # |

|

Phone # |

|

City |

|

|

|

|

|

Address |

|

|

|

State |

Zip |

2| AGENT INFORMATION The individual(s) receiving the power of attorney

Print Name of Agent |

SSN, Bar #, or CAF # |

|

Phone # |

|

City |

|

|

Address |

State |

Zip |

3| EXPIRATION The powers granted by this authorization are valid until…

Revoked. |

Liability for delinquent tax or taxes listed below is satisfied. |

(Month/Day/Year)_____________________ |

Other (explain) _________________________________ |

4 | AUTHORIZATION

4A|DESCRIPTION OF MATTER Description of the limits of the authorization

Type Of Tax | Account # (if known)

(Personal Income, Estate, etc.)

Month, Quarter, Or Year Of Return

(Date of Death if Estate Taxes)

4B| ACTS AUTHORIZED Check ONE of the Following:

4B| ACTS AUTHORIZED Check ONE of the Following:

Full Authority I hereby give the agent named above authorization to act on my behalf in interacting or communicating with the WV State Tax Department; to receive confidential information concerning me; to extend the period during which I am liable for assessment/payment of the above listed taxes; to sign and return forms; to make and sign agreements settling matters in dispute; to assign this Power of Attorney to another person approved by me in writing; and to receive (but not to endorse and cash) any checks issued by the WV Tax Department.

Full Authority I hereby give the agent named above authorization to act on my behalf in interacting or communicating with the WV State Tax Department; to receive confidential information concerning me; to extend the period during which I am liable for assessment/payment of the above listed taxes; to sign and return forms; to make and sign agreements settling matters in dispute; to assign this Power of Attorney to another person approved by me in writing; and to receive (but not to endorse and cash) any checks issued by the WV Tax Department.

Restrictions I hereby give the agent named above authorization to act for me in dealing with the WV State Tax Department with the following restrictions: ___________________________________________________________

Restrictions I hereby give the agent named above authorization to act for me in dealing with the WV State Tax Department with the following restrictions: ___________________________________________________________

_________________________________________________________________________________

_____________________________________________________________________________

Signature of PriQFLSDO,QGLYLGXDO |

Date |

|

Signature of Spouse |

Date |

(Signature of Corporate Officer if for a busLQHVV) |

|

|

(if any returns listed above are joint returns) |

|

5 | WITNESS or NOTARY Check and complete ONLY ONE of the following.

If the power of attorney is granted to a person other than an attorney or certified public accountant, the taxpayer(s) signature must be witnessed or notarized.

Witness The person(s) signing as/for the taxpayer(s) is/are known to and signed in their presence of the two disinterested witnesses who have signed below:

Witness The person(s) signing as/for the taxpayer(s) is/are known to and signed in their presence of the two disinterested witnesses who have signed below:

Signature of Witness | Date

__________________________________

Telephone #

Signature of Witness | Date

__________________________________

Telephone #

Notary The person signing as/for the taxpayer(s) appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed:

Notary The person signing as/for the taxpayer(s) appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed:

Signature of Notary | Date

NOTARY

SEAL

TAX OFFICE USE ONLY: REJECTED  ATTACHED

ATTACHED NOTED

NOTED  ___________________________________________________________

___________________________________________________________

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The WV-2848 form is used to grant power of attorney for matters regarding taxes in the state of West Virginia. |

| Primary Use | This form allows an individual to authorize another person, possibly an accountant or lawyer, to handle their tax affairs. |

| Governing Law | West Virginia tax power of attorney is governed by the laws and regulations of the State of West Virginia, specifically related to tax administration and representation before the West Virginia State Tax Department. | +

| Validity and Duration | Generally, the form remains effective until the expiration date specified by the principal or until revoked. It's important to consult current state laws or regulations for specific guidelines on duration. |

Guide to Using Tax POA wv-2848

Upon deciding to authorize someone to handle your tax matters in West Virginia, the WV-2848 form becomes a crucial document. This form allows an individual or an entity, termed as the representative, to act on behalf of another person under specified tax-related circumstances. Once the form is completed and submitted, the designated representative can perform duties as outlined, providing relief and support in tax matters. Here, a step-by-step guide is provided to ensure the form is filled out correctly and efficiently, minimizing errors and maximizing the effectiveness of the representation.

- Start by entering the taxpayer's full legal name and address in the designated fields. Include any apartment or suite number to ensure accuracy.

- Provide the taxpayer's identification numbers, including the Social Security Number (SSN) or the Employer Identification Number (EIN), as applicable.

- If the taxpayer is a business, furnish the exact name of the business as registered, along with the business address.

- State the names and addresses of the representative(s). If there are multiple representatives, each must be listed with their respective information.

- Specify the tax matters for which the representative is granted authority. This involves detailing the type of tax, the tax form number(s), and the year(s) or period(s) involved.

- Clarify the extent of the representative’s authority in this section. This includes detailing any specific additions or restrictions to the representative’s powers. Ensure to mark any applicable boxes that align with the intended level of authority.

- The taxpayer must sign and date the form. If the taxpayer is a business, an authorized individual must sign on behalf of the business. Ensure the title or capacity of the individual signing is clearly indicated.

- If applicable, the representative(s) must also sign and date the form. This acknowledges their acceptance of the role and responsibilities as outlined in the form.

After the form is fully completed and all necessary signatures are in place, it is ready to be submitted to the appropriate tax authority as indicated by the instructions. Keep in mind that processing times can vary, so allow sufficient time for the document to be processed. Following submission, the taxpayer and the designated representative should ensure they retain copies of the form for their records, staying prepared for any future inquiries or required actions. This careful approach will aid in a smoother handling of the taxpayer's affairs, contributing to a more efficient resolution of tax matters.

Essential Points on Tax POA wv-2848

What is the Tax POA WV-2848 form?

The Tax POA WV-2848 form is a document used in West Virginia that allows an individual to grant authority to another person (agent) to handle tax matters on their behalf with the West Virginia State Tax Department. This includes the ability to access confidential tax information and make decisions regarding taxes.

Who can be appointed as an agent on the Tax POA WV-2848 form?

Any individual, including family members, friends, or professionals like accountants or attorneys, can be appointed as an agent. The key requirement is that the person selected is trusted by the individual granting the power, as they will have access to sensitive tax-related information and decisions.

How does one revoke the authority given through a Tax POA WV-2848 form?

The authority granted through the Tax POA WV-2848 form can be revoked at any time by the individual who granted it. This is typically done by notifying the West Virginia State Tax Department in writing that the power of attorney is revoked and providing a copy of the revocation to the former agent.

Is there a specific period for which the Tax POA WV-2848 is valid?

Unless a specific expiration date is mentioned in the Tax POA WV-2848 form, it remains valid until formally revoked. Including an expiration date is optional but recommended if the individual only wants the agent's authority to last for a specified period.

Do I need to file a Tax POA WV-2848 form for my agent to discuss my taxes with the West Virginia State Tax Department?

Yes, to allow an agent to discuss or make decisions regarding your taxes with the West Virginia State Tax Department, you must complete and file a Tax POA WV-2848 form. Without this form on file, the Tax Department cannot share your tax information with or take action based on requests from anyone other than you.

Can the Tax POA WV-2848 form be filled out and submitted electronically?

While the West Virginia State Tax Department's requirements may change, it is important to check the current filing options. Generally, the form can be filled out electronically, but it must be printed, signed, and mailed or delivered in person to the Tax Department or the specific office handling your tax matters.

Common mistakes

When tackling the task of completing the Tax Power of Attorney (POA) WV-2848 form in West Virginia, many individuals find themselves navigating through a maze of legal terminology and procedural nuances. This document is crucial as it grants another person the authority to handle tax matters on your behalf. However, a slew of common mistakes can compromise its effectiveness or even result in its rejection. Recognizing and avoiding these errors can ensure that your tax affairs are managed smoothly and efficiently.

Here's a look at ten commonly made mistakes:

- Not providing complete information about the representative(s). Every detail, from full names to addresses, must be accurately filled out to ensure there's no ambiguity about who is being entrusted with your tax matters.

- Omitting the taxpayer’s information or filling it out incorrectly. It's vital that your personal information, including your Social Security Number or Taxpayer Identification Number, matches the records held by the tax authority.

- Failing to specify the tax matters and years or periods involved. The document should clearly outline which taxes and for what time frame the representative has authority over, to avoid any limitations on their ability to act on your behalf.

- Incomplete signatures or missing the date of the agreement. Both the taxpayer and the representative(s) must sign and date the form to validate the power of attorney.

- Skipping the designation of copies recipients. If you wish for copies of tax notices or other documents to be sent to additional parties, this section cannot be overlooked.

- Assuming the form grants unlimited authority. The West Virginia Tax POA form has specific limitations, and understanding these restrictions is crucial to ensure your expectations align with the document’s actual scope.

- Ignoring the need for a witness or notary. Depending on the jurisdiction, you might need to have the form witnessed or notarized to ensure its legality and authenticity.

- Overlooking the need to revoke previous POAs. If you're granting authority to a new representative, failing to revoke any previous power of attorney agreements can lead to confusion and conflicting directives.

- Not using the most current version of the form. Tax laws and requirements can change. Using an outdated form can mean automatic rejection.

- Submitting the form without reviewing it for errors. Even minor mistakes can result in processing delays or rejections, so a thorough review before submission is imperative.

Avoiding these mistakes requires attention to detail and an understanding of the legal and procedural requirements of the Tax POA WV-2848 form. By ensuring that all information is complete, correct, and clearly expressed, individuals can confidently delegate the management of their tax matters. It's also advisable to consult with a tax professional or attorney if there are any doubts or questions regarding the form or its implications. Ultimately, the goal is to establish a clear and legally sound agreement that enables your designated representative to act in your best interest.

Documents used along the form

The Tax Power of Attorney form, known as WV-2848 in West Virginia, is a legal document that grants an individual the authority to represent another person in matters related to state taxes. This form is often just one piece of the puzzle when dealing with tax issues in West Valley. There are several other forms and documents that individuals and businesses might need to use in conjunction with the WV-2848 form to ensure comprehensive tax management and compliance. Below is a list of these documents, including a brief description of each.

- Form IT-140: This is the West Virginia Personal Income Tax Return form. It is used by residents to file their annual state income tax. This document might be necessary to review or amend in conjunction with granting someone power of attorney over your tax matters.

- Form CST-200CU: West Virginia Combined Sales and Use Tax Return, used by businesses to report and pay sales and use taxes. This could be relevant for a power of attorney if they are handling business-related tax responsibilities.

- Form WV-941: West Virginia Employer's Quarterly Return of Income Tax Withheld form. Businesses use this form to report wages paid and taxes withheld from employees—a task a representative might oversee under the authority of a tax power of attorney.

- Form WV/LLC-12: Annual Report for Domestic and Foreign Limited Liability Companies. This form is essential for LLCs operating within West Virginia, possibly requiring action from an individual with tax power of attorney.

- Form WV-8379: Injured Spouse Allocation. This form could be necessary if a power of attorney needs to address issues related to the allocation of a tax refund when only one spouse is responsible for past due debts.

- Form WV-UC-1A: Employer's Quarterly Contribution and Wage Report. This form is crucial for reporting employment taxes and wages to the state. A representative with tax power of attorney could need to handle this if they are managing employment tax issues.

- Form IT-104: West Virginia Employee's Withholding Exemption Certificate, completed by employees to designate their state income tax withholding. It's another document that may require review or submission by someone with tax power of attorney.

- Form SPD-15: Request for Copy of Tax Return. Individuals might need to obtain previous tax returns as part of managing their tax matters under a power of attorney, using this form to request copies from the state.

Together, these forms and documents support the comprehensive handling of tax obligations and issues in West Virginia. Whether for individual or business purposes, the WV-2848 form is often just the beginning. Properly managing tax responsibilities might require the submission, amendment, or review of several related documents to ensure accuracy and compliance with state tax laws.

Similar forms

The Tax POA WV-2848 form, a power of attorney document specifically designed for tax purposes in West Virginia, shares similarities with various other legal documents, each serving a unique yet somewhat related function. For instance, the IRS Form 2848, Power of Attorney and Declaration of Representative, is its close counterpart at the federal level. This form grants someone authority to represent the taxpayer before the IRS, allowing the designated representative to receive confidential tax information and make decisions regarding federal tax matters, mirroring the WV-2848's state-level authority for tax representation.

Another related document is the General Power of Attorney. This broad legal instrument authorizes an agent to act on another person's behalf in a variety of matters, not limited to taxes but including financial and personal affairs. Unlike the Tax POA WV-2848, which is restricted to tax matters within West Virginia, a General Power of Attorney can encompass an array of actions and decisions, from buying real estate to managing bank accounts, offering a wider scope of authority.

The Healthcare Power of Attorney is a document that specifically deals with medical decisions. It authorizes an agent to make healthcare-related decisions on behalf of the person who created the document, should they become incapacitated. While both documents empower someone else to act on the individual's behalf, the Healthcare Power of Attorney is focused solely on medical choices, differing from the Tax POA WV-2848's fiscal orientation.

A Living Will, although not a power of attorney document, is also worth mentioning for its role in personal decision-making. It outlines a person's wishes regarding medical treatment and life support in end-of-life situations. The connection here lies in the foundational idea of preparing for circumstances where one cannot make decisions independently, a purpose shared by the Tax POA WV-2848, albeit in the realm of healthcare preferences rather than tax matters.

The Durable Power of Attorney for Finance is a specific type of power of attorney that remains effective even if the individual becomes mentally incapacitated. It gives the appointed agent authority to handle financial matters, potentially including tax issues, on behalf of the person. This similarity in financial domain shows a parallel to the Tax POA WV-2848, although the Durable Power of Attorney for Finance has a broader application and doesn't automatically cease if the person's mental state deteriorates.

Limited Power of Attorney is another relative, sharply defined by its specificity. It grants an agent authority to perform specific acts or duties for a limited period of time, for example, selling a property or managing a particular financial transaction. While it can be tailored to include tax matters, similar to the Tax POA WV-2848, its scope is defined by the task at hand rather than encompassing all tax-related situations.

Lastly, the Advance Directive is a document that combines features of a Living Will and a Healthcare Power of Attorney. It allows individuals to document their healthcare preferences and appoint someone to make healthcare decisions on their behalf. Though its focus is strictly on health care, it shares with the Tax POA WV-2848 the fundamental purpose of appointing another to act in one's stead, preparing for situations where personal decision-making is impaired or impossible.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) WV-2848 form is an important step in managing your tax matters in West Virginia. This document grants another individual the authority to handle tax affairs on your behalf. Here are ten do's and don'ts to ensure the process is smooth and effective.

- Do read the instructions carefully before you start filling out the form. Understanding the form's requirements will help ensure accurate completion.

- Do verify that the person or firm you are appointing as your representative is trustworthy and has a good understanding of tax laws in West Virginia.

- Do include all necessary information such as your full name, address, and tax identification number to avoid any delays or confusion.

- Do specify the tax matters and periods for which the power is granted. This clarity helps limit your representative’s authority to your intended scope.

- Do sign and date the form. Without your signature, the form will not be valid.

- Don't leave any sections blank. Incomplete forms can be rejected or cause unnecessary delays.

- Don't appoint a representative without discussing your tax matters with them first. Ensuring they’re fully briefed can help prevent misunderstandings later on.

- Don't forget to inform your tax representative if any of the information you provided changes, or if you wish to revoke the power of attorney.

- Don't use the form to grant broader powers than necessary. Limiting the power of attorney to specific tax issues can protect you from unauthorized actions.

- Don't hesitate to seek help if you’re unsure about how to complete the form correctly. Consulting with a tax professional or an attorney can provide clarity and peace of mind.

Properly completing and submitting the Tax POA WV-2848 form is vital for ensuring your tax matters are handled according to your wishes. By following these dos and don'ts, you can appoint a representative with confidence, knowing your tax affairs are in competent hands.

Misconceptions

When it comes to the Tax Power of Attorney (POA), WV-2848 form, several misconceptions commonly circulate. These misunderstandings can create confusion, leading to errors or inefficiencies in tax management and representation. Let's clear up some of these myths.

- Only attorneys can be designated. Many believe that the power to handle tax affairs through the WV-2848 form is exclusively reserved for attorneys. However, this is not the case. Certified public accountants, family members, or other individuals trusted by the taxpayer can also be designated, provided they meet the state's requirements for representation.

- It grants unlimited power. Another common myth is that the WV-2848 form gives the representative unlimited power over the taxpayer's affairs. In reality, the scope of authority is defined by what is specifically granted in the form. Representatives can only perform acts that the taxpayer has explicitly authorized.

- The form is irreversable. Many are under the impression once the Tax POA form is filed, it can't be revoked. This isn't true. The taxpayer retains the right to revoke the power of attorney at any time, for any reason, as long as the revocation process outlined by West Virginia tax law is followed.

- It's effective immediately and forever. A misunderstanding exists that once signed, the WV-2848 is effective immediately and remains in effect indefinitely. The truth is that the effective date and duration of the authority granted can be tailored by the taxpayer. Specific start and end dates can be detailed within the form.

- Filing the form is a lengthy process. Some taxpayers hesitate to use the WV-2848, believing that the process is complicated and time-consuming. While it's important to complete the form carefully and accurately, the actual process can be straightforward and is designed to ensure taxpayers can easily grant representation for their tax matters.

- Use of the form is limited to tax disputes. There's a notion that the WV-2848 is only useful when disputing tax filings or liabilities. In fact, the form can be used to grant representatives the authority to handle a wide range of tax-related matters, from filing returns to obtaining private taxpayer information and making payment arrangements on behalf of the taxpayer.

Understanding these points helps demystify the Tax POA process in West Virginia, encouraging more informed decisions and smoother handling of tax-related matters.

Key takeaways

Filling out the Tax Power of Attorney (POA) WV-2848 form in West Virginia is a significant step for individuals or entities needing to authorize another person to handle their tax matters. Here are key takeaways regarding the preparation and use of this form:

Understand the Purpose: The Tax POA WV-2848 provides a way for a taxpayer to grant authority to a representative, such as an accountant or attorney, to act on their behalf in tax matters before the West Virginia State Tax Department.

Identify the Representative: Clearly identify the person or entity being appointed as the representative, including their name, address, and contact information. This ensures the West Virginia State Tax Department knows whom to communicate with about the taxpayer's affairs.

Scope of Authority: Specify the tax matters and years or periods for which the representative is granted authority. This clarity prevents any confusion about what the representative can and cannot do.

Duration: The form allows for a limitation on the duration of the power granted. If a time frame is desired, it should be clearly provided to ensure that the authorization does not extend beyond the intended period.

Multiple Representatives: If appointing more than one representative, the form includes the option to require these representatives to act together or to allow them to act independently of each other.

Revocation: Understand that the Tax POA WV-2848 remains in effect until explicitly revoked. Revocation can be accomplished through a written document submitted to the West Virginia State Tax Department.

Signature and Date: For the Tax POA WV-2848 to be considered valid, it must be signed and dated by the taxpayer or a duly authorized representative of an entity taxpayer. This is a critical step to formalize the document.

Witness or Notarization: While the Tax POA WV-2848 form does not specifically require notarization, ensuring that the form is properly witnessed or notarized can add an extra layer of authenticity and may help prevent disputes regarding its validity.

Using the Tax POA WV-2848 form accurately and thoughtfully can ensure that your tax matters are handled efficiently and according to your wishes. It's always recommended to consult with a professional if you have questions or need assistance in filling out the form.

Popular PDF Forms

Wv Court Forms - Provides a detailed walkthrough for reporting real estate interests, ensuring that all property, including out-of-state holdings, is accurately documented and valued in the estate inventory.

Wvuc-a-154 - Advises employers on the strategic importance of their payroll taxes as an investment in the state’s economic stability.